The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Camden Property Trust (NYSE:CPT), and what that likely means for the prospects of the company and its stock.

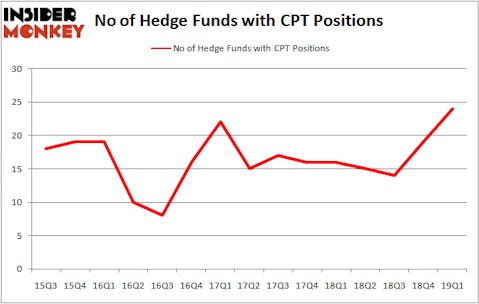

Is Camden Property Trust (NYSE:CPT) a buy, sell, or hold? Investors who are in the know are betting on the stock. The number of bullish hedge fund bets inched up by 5 in recent months. Our calculations also showed that CPT isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a large number of metrics market participants use to evaluate stocks. A couple of the most innovative metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top money managers can outpace the market by a significant amount (see the details here).

We’re going to go over the recent hedge fund action regarding Camden Property Trust (NYSE:CPT).

What does the smart money think about Camden Property Trust (NYSE:CPT)?

At Q1’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CPT over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Camden Property Trust (NYSE:CPT), which was worth $87.1 million at the end of the first quarter. On the second spot was AEW Capital Management which amassed $84.8 million worth of shares. Moreover, Citadel Investment Group, Renaissance Technologies, and Balyasny Asset Management were also bullish on Camden Property Trust (NYSE:CPT), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have been driving this bullishness. Carlson Capital, managed by Clint Carlson, initiated the most valuable position in Camden Property Trust (NYSE:CPT). Carlson Capital had $14.2 million invested in the company at the end of the quarter. Josh Donfeld and David Rogers’s Castle Hook Partners also made a $4.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Benjamin A. Smith’s Laurion Capital Management, Richard Driehaus’s Driehaus Capital, and Matthew Tewksbury’s Stevens Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Camden Property Trust (NYSE:CPT) but similarly valued. These stocks are Fidelity National Financial Inc (NYSE:FNF), NVR, Inc. (NYSE:NVR), China Eastern Airlines Corp. Ltd. (NYSE:CEA), and Goldcorp Inc. (NYSE:GG). This group of stocks’ market valuations are closest to CPT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNF | 30 | 427989 | 2 |

| NVR | 25 | 883152 | -6 |

| CEA | 1 | 1543 | -1 |

| GG | 35 | 871456 | 11 |

| Average | 22.75 | 546035 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $546 million. That figure was $428 million in CPT’s case. Goldcorp Inc. (NYSE:GG) is the most popular stock in this table. On the other hand China Eastern Airlines Corp. Ltd. (NYSE:CEA) is the least popular one with only 1 bullish hedge fund positions. Camden Property Trust (NYSE:CPT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CPT, though not to the same extent, as the stock returned 0.7% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.