World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Is Brighthouse Financial, Inc. (NASDAQ:BHF) a buy right now? Money managers are buying. The number of long hedge fund bets rose by 7 in recent months. Our calculations also showed that bhf isn’t among the 30 most popular stocks among hedge funds. BHF was in 31 hedge funds’ portfolios at the end of the first quarter of 2019. There were 24 hedge funds in our database with BHF holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action surrounding Brighthouse Financial, Inc. (NASDAQ:BHF).

Hedge fund activity in Brighthouse Financial, Inc. (NASDAQ:BHF)

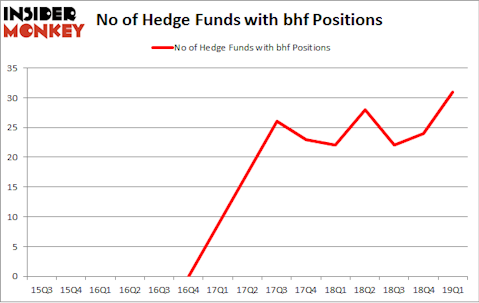

Heading into the second quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BHF over the last 15 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Greenlight Capital, managed by David Einhorn, holds the number one position in Brighthouse Financial, Inc. (NASDAQ:BHF). Greenlight Capital has a $119.5 million position in the stock, comprising 8.5% of its 13F portfolio. On Greenlight Capital’s heels is Diamond Hill Capital, led by Ric Dillon, holding a $94.9 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Remaining peers with similar optimism comprise Mike Masters’s Masters Capital Management, Israel Englander’s Millennium Management and Steven Richman’s East Side Capital (RR Partners).

As industrywide interest jumped, key hedge funds have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the largest position in Brighthouse Financial, Inc. (NASDAQ:BHF). Balyasny Asset Management had $15.9 million invested in the company at the end of the quarter. Murray Stahl’s Horizon Asset Management also made a $14.6 million investment in the stock during the quarter. The other funds with brand new BHF positions are Jeffrey Talpins’s Element Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Jim Simons’s Renaissance Technologies.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Brighthouse Financial, Inc. (NASDAQ:BHF) but similarly valued. We will take a look at Marriott Vacations Worldwide Corporation (NYSE:VAC), J2 Global Inc (NASDAQ:JCOM), Ryman Hospitality Properties, Inc. (NYSE:RHP), and Taro Pharmaceutical Industries Ltd. (NYSE:TARO). This group of stocks’ market caps resemble BHF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VAC | 26 | 399866 | 0 |

| JCOM | 22 | 264086 | 5 |

| RHP | 18 | 477090 | 0 |

| TARO | 10 | 74462 | 2 |

| Average | 19 | 303876 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $304 million. That figure was $378 million in BHF’s case. Marriott Vacations Worldwide Corporation (NYSE:VAC) is the most popular stock in this table. On the other hand Taro Pharmaceutical Industries Ltd. (NYSE:TARO) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Brighthouse Financial, Inc. (NASDAQ:BHF) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on BHF as the stock returned 2.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.