We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of Braemar Hotels & Resorts Inc. (NYSE:BHR).

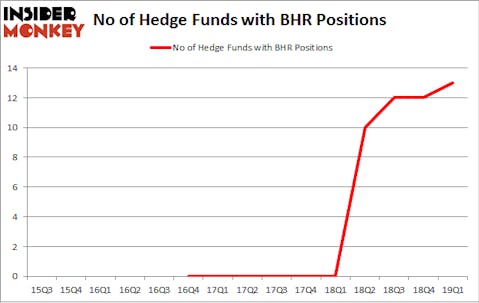

Braemar Hotels & Resorts Inc. (NYSE:BHR) was in 13 hedge funds’ portfolios at the end of March. BHR has seen an increase in hedge fund interest of late. There were 12 hedge funds in our database with BHR holdings at the end of the previous quarter. Our calculations also showed that bhr isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are many formulas shareholders can use to appraise their holdings. A couple of the less utilized formulas are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the best money managers can outclass their index-focused peers by a healthy margin (see the details here).

James Dondero of Highland Capital Management

We’re going to take a glance at the latest hedge fund action surrounding Braemar Hotels & Resorts Inc. (NYSE:BHR).

What does smart money think about Braemar Hotels & Resorts Inc. (NYSE:BHR)?

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the fourth quarter of 2018. By comparison, 0 hedge funds held shares or bullish call options in BHR a year ago. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

More specifically, Highland Capital Management was the largest shareholder of Braemar Hotels & Resorts Inc. (NYSE:BHR), with a stake worth $29.9 million reported as of the end of March. Trailing Highland Capital Management was Forward Management, which amassed a stake valued at $16.3 million. Renaissance Technologies, Caerus Global Investors, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names were leading the bulls’ herd. Element Capital Management, managed by Jeffrey Talpins, initiated the most valuable position in Braemar Hotels & Resorts Inc. (NYSE:BHR). Element Capital Management had $0.2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.1 million position during the quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Braemar Hotels & Resorts Inc. (NYSE:BHR) but similarly valued. These stocks are New Frontier Corp (NYSE:NFC), DryShips Inc. (NASDAQ:DRYS), GenMark Diagnostics, Inc (NASDAQ:GNMK), and Avalon GloboCare Corp. (NASDAQ:AVCO). This group of stocks’ market caps match BHR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NFC | 13 | 64688 | -1 |

| DRYS | 3 | 171 | 2 |

| GNMK | 14 | 76000 | 2 |

| AVCO | 3 | 1423 | 2 |

| Average | 8.25 | 35571 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $70 million in BHR’s case. GenMark Diagnostics, Inc (NASDAQ:GNMK) is the most popular stock in this table. On the other hand DryShips Inc. (NASDAQ:DRYS) is the least popular one with only 3 bullish hedge fund positions. Braemar Hotels & Resorts Inc. (NYSE:BHR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BHR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BHR were disappointed as the stock returned -17.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.