The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31 holdings, data that is available nowhere else. Should you consider Black Knight, Inc. (NYSE:BKI) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

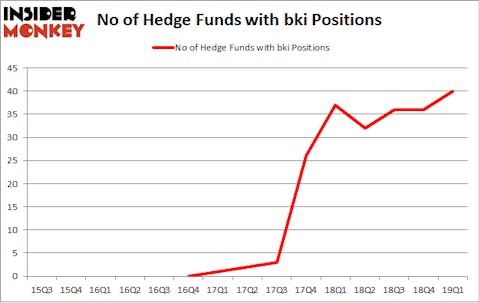

Black Knight, Inc. (NYSE:BKI) shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. BKI was in 40 hedge funds’ portfolios at the end of March. There were 36 hedge funds in our database with BKI positions at the end of the previous quarter. Our calculations also showed that bki isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are perceived as slow, outdated investment vehicles of the past. While there are more than 8000 funds trading at the moment, Our researchers hone in on the masters of this club, around 750 funds. Most estimates calculate that this group of people administer the lion’s share of the hedge fund industry’s total capital, and by monitoring their inimitable picks, Insider Monkey has determined many investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to view the latest hedge fund action regarding Black Knight, Inc. (NYSE:BKI).

Hedge fund activity in Black Knight, Inc. (NYSE:BKI)

Heading into the second quarter of 2019, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BKI over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Palestra Capital Management was the largest shareholder of Black Knight, Inc. (NYSE:BKI), with a stake worth $163.2 million reported as of the end of March. Trailing Palestra Capital Management was D E Shaw, which amassed a stake valued at $152.3 million. Citadel Investment Group, Third Point, and Aravt Global were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers were leading the bulls’ herd. Palestra Capital Management, managed by Andrew Immerman and Jeremy Schiffman, initiated the most valuable position in Black Knight, Inc. (NYSE:BKI). Palestra Capital Management had $163.2 million invested in the company at the end of the quarter. Dan Loeb’s Third Point also made a $95.4 million investment in the stock during the quarter. The following funds were also among the new BKI investors: Will Cook’s Sunriver Management, Sander Gerber’s Hudson Bay Capital Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Black Knight, Inc. (NYSE:BKI) but similarly valued. We will take a look at Jazz Pharmaceuticals plc (NASDAQ:JAZZ), Booz Allen Hamilton Holding Corporation (NYSE:BAH), West Pharmaceutical Services Inc. (NYSE:WST), and Vereit Inc (NYSE:VER). This group of stocks’ market values match BKI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JAZZ | 27 | 772683 | -4 |

| BAH | 19 | 230572 | -7 |

| WST | 21 | 290123 | 1 |

| VER | 21 | 403492 | 3 |

| Average | 22 | 424218 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $424 million. That figure was $991 million in BKI’s case. Jazz Pharmaceuticals plc (NASDAQ:JAZZ) is the most popular stock in this table. On the other hand Booz Allen Hamilton Holding Corporation (NYSE:BAH) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Black Knight, Inc. (NYSE:BKI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on BKI as the stock returned 4.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.