We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of BEST Inc. (NYSE:BEST) based on that data.

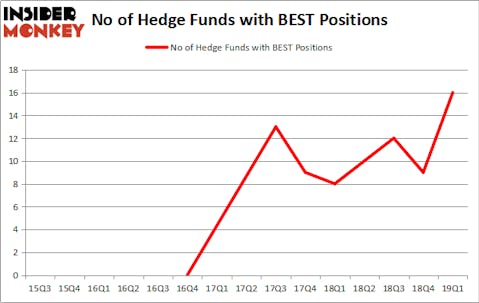

BEST Inc. (NYSE:BEST) was in 16 hedge funds’ portfolios at the end of March. BEST shareholders have witnessed an increase in hedge fund sentiment of late. There were 9 hedge funds in our database with BEST positions at the end of the previous quarter. Our calculations also showed that BEST isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of metrics market participants use to value their stock investments. Some of the most under-the-radar metrics are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite fund managers can outperform their index-focused peers by a solid amount (see the details here).

We’re going to review the key hedge fund action surrounding BEST Inc. (NYSE:BEST).

How have hedgies been trading BEST Inc. (NYSE:BEST)?

Heading into the second quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 78% from the previous quarter. By comparison, 8 hedge funds held shares or bullish call options in BEST a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Tiger Pacific Capital, managed by Run Ye, Junji Takegami and Hoyon Hwang, holds the largest position in BEST Inc. (NYSE:BEST). Tiger Pacific Capital has a $23.7 million position in the stock, comprising 8% of its 13F portfolio. The second most bullish fund manager is Israel Englander of Millennium Management, with a $7.3 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Other peers with similar optimism comprise David Kowitz and Sheldon Kasowitz’s Indus Capital, Hari Hariharan’s NWI Management and Gifford Combs’s Dalton Investments.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, established the most outsized position in BEST Inc. (NYSE:BEST). LMR Partners had $2.8 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $1.8 million investment in the stock during the quarter. The following funds were also among the new BEST investors: Michael Gelband’s ExodusPoint Capital, Richard Driehaus’s Driehaus Capital, and Minhua Zhang’s Weld Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as BEST Inc. (NYSE:BEST) but similarly valued. We will take a look at Four Corners Property Trust, Inc. (NYSE:FCPT), Power Integrations Inc (NASDAQ:POWI), Invesco Mortgage Capital Inc (NYSE:IVR), and Commercial Metals Company (NYSE:CMC). All of these stocks’ market caps resemble BEST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FCPT | 13 | 92837 | 0 |

| POWI | 6 | 79088 | 2 |

| IVR | 15 | 94994 | 2 |

| CMC | 11 | 275034 | -6 |

| Average | 11.25 | 135488 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $63 million in BEST’s case. Invesco Mortgage Capital Inc (NYSE:IVR) is the most popular stock in this table. On the other hand Power Integrations Inc (NASDAQ:POWI) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks BEST Inc. (NYSE:BEST) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BEST wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BEST were disappointed as the stock returned -5.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.