Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

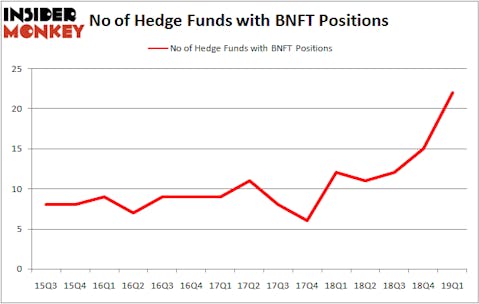

Benefitfocus Inc (NASDAQ:BNFT) has seen an increase in hedge fund interest of late. Our calculations also showed that BNFT isn’t among the 30 most popular stocks among hedge funds.

Today there are tons of signals stock traders use to assess stocks. A duo of the most innovative signals are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the elite money managers can trounce the broader indices by a superb margin (see the details here).

We’re going to analyze the recent hedge fund action regarding Benefitfocus Inc (NASDAQ:BNFT).

How are hedge funds trading Benefitfocus Inc (NASDAQ:BNFT)?

Heading into the second quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 47% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in BNFT a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Benefitfocus Inc (NASDAQ:BNFT), which was worth $64.8 million at the end of the first quarter. On the second spot was Point72 Asset Management which amassed $25.2 million worth of shares. Moreover, Polar Capital, D E Shaw, and Two Sigma Advisors were also bullish on Benefitfocus Inc (NASDAQ:BNFT), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, specific money managers were breaking ground themselves. Laurion Capital Management, managed by Benjamin A. Smith, assembled the most valuable position in Benefitfocus Inc (NASDAQ:BNFT). Laurion Capital Management had $12.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $11.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, Josh Goldberg’s G2 Investment Partners Management, and Jonathan Auerbach’s Hound Partners.

Let’s go over hedge fund activity in other stocks similar to Benefitfocus Inc (NASDAQ:BNFT). We will take a look at Global Net Lease, Inc. (NYSE:GNL), OSI Systems, Inc. (NASDAQ:OSIS), HNI Corp (NYSE:HNI), and Heartland Express, Inc. (NASDAQ:HTLD). This group of stocks’ market values resemble BNFT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNL | 11 | 77172 | 4 |

| OSIS | 10 | 25967 | 5 |

| HNI | 18 | 34722 | 0 |

| HTLD | 14 | 27625 | 7 |

| Average | 13.25 | 41372 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $214 million in BNFT’s case. HNI Corp (NYSE:HNI) is the most popular stock in this table. On the other hand OSI Systems, Inc. (NASDAQ:OSIS) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Benefitfocus Inc (NASDAQ:BNFT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BNFT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BNFT were disappointed as the stock returned -41.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.