A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of AZZ Incorporated (NYSE:AZZ) during the quarter.

Is AZZ Incorporated (NYSE:AZZ) a buy right now? Money managers are betting on the stock. The number of bullish hedge fund bets increased by 1 recently. Our calculations also showed that AZZ isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most market participants, hedge funds are viewed as unimportant, old investment vehicles of the past. While there are more than 8000 funds in operation today, Our researchers choose to focus on the leaders of this club, approximately 750 funds. These money managers control most of the hedge fund industry’s total asset base, and by paying attention to their inimitable stock picks, Insider Monkey has revealed a number of investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s view the latest hedge fund action surrounding AZZ Incorporated (NYSE:AZZ).

What does smart money think about AZZ Incorporated (NYSE:AZZ)?

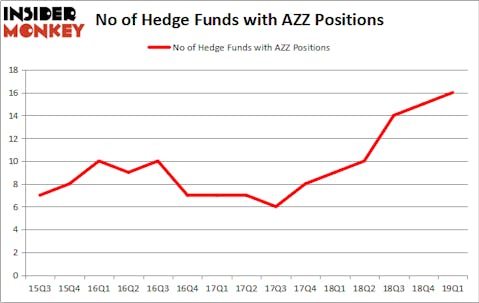

At the end of the first quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in AZZ a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

More specifically, Rutabaga Capital Management was the largest shareholder of AZZ Incorporated (NYSE:AZZ), with a stake worth $12.5 million reported as of the end of March. Trailing Rutabaga Capital Management was D E Shaw, which amassed a stake valued at $5.6 million. Renaissance Technologies, Citadel Investment Group, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the largest position in AZZ Incorporated (NYSE:AZZ). Marshall Wace LLP had $1.6 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $1 million position during the quarter. The other funds with brand new AZZ positions are Ken Griffin’s Citadel Investment Group, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as AZZ Incorporated (NYSE:AZZ) but similarly valued. These stocks are Benchmark Electronics, Inc. (NYSE:BHE), Astronics Corporation (NASDAQ:ATRO), Piper Jaffray Companies (NYSE:PJC), and Five Point Holdings, LLC (NYSE:FPH). All of these stocks’ market caps match AZZ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHE | 19 | 75180 | 7 |

| ATRO | 13 | 104004 | 6 |

| PJC | 8 | 46296 | 3 |

| FPH | 16 | 273200 | 0 |

| Average | 14 | 124670 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $125 million. That figure was $44 million in AZZ’s case. Benchmark Electronics, Inc. (NYSE:BHE) is the most popular stock in this table. On the other hand Piper Jaffray Companies (NYSE:PJC) is the least popular one with only 8 bullish hedge fund positions. AZZ Incorporated (NYSE:AZZ) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on AZZ as the stock returned 7.4% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.