Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Axis Capital Holdings Limited (NYSE:AXS).

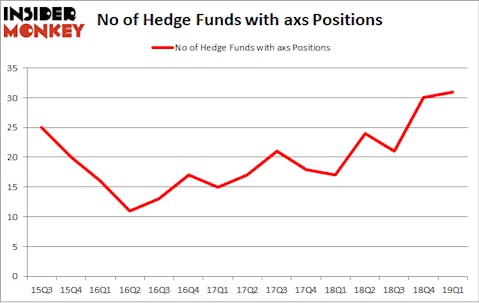

Is Axis Capital Holdings Limited (NYSE:AXS) a buy here? Investors who are in the know are becoming hopeful. The number of long hedge fund bets improved by 1 in recent months. Our calculations also showed that axs isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

Let’s take a glance at the fresh hedge fund action regarding Axis Capital Holdings Limited (NYSE:AXS).

What does the smart money think about Axis Capital Holdings Limited (NYSE:AXS)?

At Q1’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in AXS a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Pzena Investment Management held the most valuable stake in Axis Capital Holdings Limited (NYSE:AXS), which was worth $302.6 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $106.1 million worth of shares. Moreover, AQR Capital Management, Citadel Investment Group, and GLG Partners were also bullish on Axis Capital Holdings Limited (NYSE:AXS), allocating a large percentage of their portfolios to this stock.

Now, key money managers have been driving this bullishness. PDT Partners, managed by Peter Muller, assembled the most outsized position in Axis Capital Holdings Limited (NYSE:AXS). PDT Partners had $4.3 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $1.8 million position during the quarter. The following funds were also among the new AXS investors: Michael Gelband’s ExodusPoint Capital, Brandon Haley’s Holocene Advisors, and David Harding’s Winton Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Axis Capital Holdings Limited (NYSE:AXS) but similarly valued. We will take a look at Shell Midstream Partners LP (NYSE:SHLX), MSC Industrial Direct Co Inc (NYSE:MSM), NovoCure Limited (NASDAQ:NVCR), and Carter’s, Inc. (NYSE:CRI). This group of stocks’ market caps are closest to AXS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHLX | 7 | 21377 | -1 |

| MSM | 14 | 74589 | -7 |

| NVCR | 25 | 331474 | 8 |

| CRI | 19 | 278631 | -3 |

| Average | 16.25 | 176518 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $177 million. That figure was $767 million in AXS’s case. NovoCure Limited (NASDAQ:NVCR) is the most popular stock in this table. On the other hand Shell Midstream Partners LP (NYSE:SHLX) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Axis Capital Holdings Limited (NYSE:AXS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on AXS as the stock returned 7% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.