We can judge whether Atlassian Corporation Plc (NASDAQ:TEAM) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

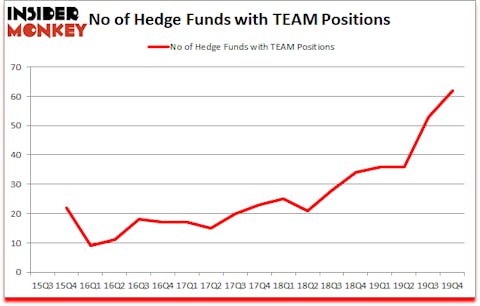

Is Atlassian Corporation Plc (NASDAQ:TEAM) ready to rally soon? Investors who are in the know are becoming hopeful. The number of long hedge fund bets rose by 9 in recent months. Our calculations also showed that TEAM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). TEAM was in 62 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 53 hedge funds in our database with TEAM holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Jim Simons of Renaissance Technologies

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind let’s take a glance at the latest hedge fund action regarding Atlassian Corporation Plc (NASDAQ:TEAM).

Hedge fund activity in Atlassian Corporation Plc (NASDAQ:TEAM)

Heading into the first quarter of 2020, a total of 62 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TEAM over the last 18 quarters. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in Atlassian Corporation Plc (NASDAQ:TEAM) was held by Renaissance Technologies, which reported holding $731.9 million worth of stock at the end of September. It was followed by Lone Pine Capital with a $336.9 million position. Other investors bullish on the company included Citadel Investment Group, Tybourne Capital Management, and Tiger Global Management LLC. In terms of the portfolio weights assigned to each position Strategy Capital allocated the biggest weight to Atlassian Corporation Plc (NASDAQ:TEAM), around 17.73% of its 13F portfolio. Tybourne Capital Management is also relatively very bullish on the stock, setting aside 7.19 percent of its 13F equity portfolio to TEAM.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Steadfast Capital Management, managed by Robert Pitts, created the biggest position in Atlassian Corporation Plc (NASDAQ:TEAM). Steadfast Capital Management had $121.4 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $97.7 million investment in the stock during the quarter. The other funds with brand new TEAM positions are Anand Parekh’s Alyeska Investment Group, Leon Shaulov’s Maplelane Capital, and Richard Walters II’s Stony Point Capital.

Let’s go over hedge fund activity in other stocks similar to Atlassian Corporation Plc (NASDAQ:TEAM). We will take a look at AvalonBay Communities Inc (NYSE:AVB), Canon Inc. (NYSE:CAJ), Wisconsin Energy Group, Inc. (NYSE:WEC), and Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC). This group of stocks’ market valuations match TEAM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVB | 23 | 442044 | 2 |

| CAJ | 8 | 69992 | 0 |

| WEC | 15 | 211776 | -7 |

| ERIC | 18 | 367933 | -2 |

| Average | 16 | 272936 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $273 million. That figure was $2649 million in TEAM’s case. AvalonBay Communities Inc (NYSE:AVB) is the most popular stock in this table. On the other hand Canon Inc. (NYSE:CAJ) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Atlassian Corporation Plc (NASDAQ:TEAM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on TEAM as the stock returned 22% so far in Q1 (through March 2nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.