Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

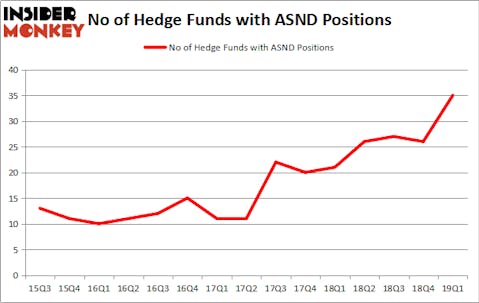

Ascendis Pharma A/S (NASDAQ:ASND) was in 35 hedge funds’ portfolios at the end of March. ASND investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 26 hedge funds in our database with ASND positions at the end of the previous quarter. Our calculations also showed that ASND isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the fresh hedge fund action regarding Ascendis Pharma A/S (NASDAQ:ASND).

How have hedgies been trading Ascendis Pharma A/S (NASDAQ:ASND)?

At Q1’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 35% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ASND over the last 15 quarters. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Peter Kolchinsky’s RA Capital Management has the largest position in Ascendis Pharma A/S (NASDAQ:ASND), worth close to $486.4 million, corresponding to 21% of its total 13F portfolio. The second most bullish fund manager is Samuel Isaly of OrbiMed Advisors, with a $467.3 million position; 7.2% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism consist of Julian Baker and Felix Baker’s Baker Bros. Advisors, Albert Cha and Frank Kung’s Vivo Capital and Behzad Aghazadeh’s venBio Select Advisor.

As one would reasonably expect, key money managers have been driving this bullishness. Camber Capital Management, managed by Stephen DuBois, initiated the biggest position in Ascendis Pharma A/S (NASDAQ:ASND). Camber Capital Management had $50.6 million invested in the company at the end of the quarter. Jeffrey Jay and David Kroin’s Great Point Partners also made a $48.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, James A. Silverman’s Opaleye Management, and Michael Castor’s Sio Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Ascendis Pharma A/S (NASDAQ:ASND). We will take a look at DCP Midstream LP (NYSE:DCP), BRF S.A. (NYSE:BRFS), Paylocity Holding Corp (NASDAQ:PCTY), and Casey’s General Stores, Inc. (NASDAQ:CASY). This group of stocks’ market valuations resemble ASND’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCP | 2 | 8323 | -3 |

| BRFS | 10 | 53894 | 1 |

| PCTY | 24 | 148784 | 10 |

| CASY | 18 | 51288 | 0 |

| Average | 13.5 | 65572 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $2904 million in ASND’s case. Paylocity Holding Corp (NASDAQ:PCTY) is the most popular stock in this table. On the other hand DCP Midstream LP (NYSE:DCP) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Ascendis Pharma A/S (NASDAQ:ASND) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ASND as the stock returned 9.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.