Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by more than 6 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Arcosa, Inc. (NYSE:ACA) from the perspective of those elite funds.

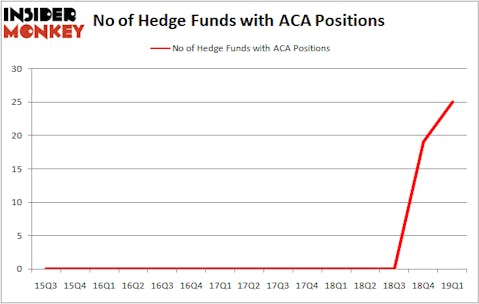

Arcosa, Inc. (NYSE:ACA) has experienced an increase in hedge fund interest of late. Our calculations also showed that ACA isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are perceived as unimportant, old financial vehicles of yesteryear. While there are more than 8000 funds with their doors open today, We choose to focus on the masters of this group, about 750 funds. These hedge fund managers command most of all hedge funds’ total asset base, and by watching their top stock picks, Insider Monkey has uncovered many investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to review the recent hedge fund action encompassing Arcosa, Inc. (NYSE:ACA).

Hedge fund activity in Arcosa, Inc. (NYSE:ACA)

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 32% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ACA over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, ValueAct Capital was the largest shareholder of Arcosa, Inc. (NYSE:ACA), with a stake worth $175.4 million reported as of the end of March. Trailing ValueAct Capital was Royce & Associates, which amassed a stake valued at $34.5 million. Yacktman Asset Management, Marshall Wace LLP, and Rutabaga Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have jumped into Arcosa, Inc. (NYSE:ACA) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the biggest position in Arcosa, Inc. (NYSE:ACA). Marshall Wace LLP had $20.8 million invested in the company at the end of the quarter. Zachary Miller’s Parian Global Management also initiated a $9.6 million position during the quarter. The other funds with brand new ACA positions are Frederick DiSanto’s Ancora Advisors, Benjamin A. Smith’s Laurion Capital Management, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks similar to Arcosa, Inc. (NYSE:ACA). We will take a look at MicroStrategy Incorporated (NASDAQ:MSTR), Central Garden & Pet Co (NASDAQ:CENT), Park National Corporation (NYSE:PRK), and MRC Global Inc (NYSE:MRC). This group of stocks’ market caps are similar to ACA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSTR | 20 | 185060 | -3 |

| CENT | 16 | 124562 | -8 |

| PRK | 5 | 12810 | -2 |

| MRC | 18 | 105875 | 3 |

| Average | 14.75 | 107077 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $107 million. That figure was $345 million in ACA’s case. MicroStrategy Incorporated (NASDAQ:MSTR) is the most popular stock in this table. On the other hand Park National Corporation (NYSEAMEX:PRK) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Arcosa, Inc. (NYSE:ACA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ACA as the stock returned 14.8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.