Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the fourth quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of Analog Devices, Inc. (NASDAQ:ADI) based on that data.

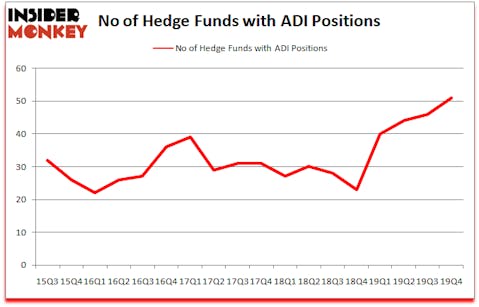

Analog Devices, Inc. (NASDAQ:ADI) has experienced an increase in activity from the world’s largest hedge funds lately. ADI was in 51 hedge funds’ portfolios at the end of December. There were 46 hedge funds in our database with ADI holdings at the end of the previous quarter. Our calculations also showed that ADI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are assumed to be worthless, outdated investment tools of the past. While there are more than 8000 funds with their doors open at present, Our experts choose to focus on the crème de la crème of this club, approximately 850 funds. These money managers administer bulk of the hedge fund industry’s total capital, and by keeping an eye on their unrivaled stock picks, Insider Monkey has discovered various investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

William Von Mueffling of Cantillon Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s take a peek at the key hedge fund action regarding Analog Devices, Inc. (NASDAQ:ADI).

Hedge fund activity in Analog Devices, Inc. (NASDAQ:ADI)

At Q4’s end, a total of 51 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ADI over the last 18 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

More specifically, Cantillon Capital Management was the largest shareholder of Analog Devices, Inc. (NASDAQ:ADI), with a stake worth $588.4 million reported as of the end of September. Trailing Cantillon Capital Management was First Pacific Advisors LLC, which amassed a stake valued at $469.2 million. Generation Investment Management, Alkeon Capital Management, and Lansdowne Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Totem Point Management allocated the biggest weight to Analog Devices, Inc. (NASDAQ:ADI), around 14.44% of its 13F portfolio. Cavalry Asset Management is also relatively very bullish on the stock, designating 7.7 percent of its 13F equity portfolio to ADI.

Now, key hedge funds have been driving this bullishness. Lansdowne Partners, managed by Alex Snow, assembled the largest position in Analog Devices, Inc. (NASDAQ:ADI). Lansdowne Partners had $132.1 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $56.7 million position during the quarter. The other funds with new positions in the stock are Mikal Patel’s Oribel Capital Management, Leon Shaulov’s Maplelane Capital, and Louis Bacon’s Moore Global Investments.

Let’s now take a look at hedge fund activity in other stocks similar to Analog Devices, Inc. (NASDAQ:ADI). We will take a look at Infosys Limited (NYSE:INFY), L3Harris Technologies, Inc. (NYSE:LHX), SYSCO Corporation (NYSE:SYY), and National Grid plc (NYSE:NGG). This group of stocks’ market caps are similar to ADI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INFY | 25 | 1464953 | -1 |

| LHX | 48 | 2542147 | -3 |

| SYY | 28 | 3021435 | 3 |

| NGG | 6 | 439511 | -4 |

| Average | 26.75 | 1867012 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $1867 million. That figure was $2514 million in ADI’s case. L3Harris Technologies, Inc. (NYSE:LHX) is the most popular stock in this table. On the other hand National Grid plc (NYSE:NGG) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Analog Devices, Inc. (NASDAQ:ADI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th and still beat the market by 1.9 percentage points. Unfortunately ADI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ADI were disappointed as the stock returned -17.5% during the first two months of 2020 (through March 9th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Disclosure: None. This article was originally published at Insider Monkey.