Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of AbbVie Inc (NYSE:ABBV) based on that data.

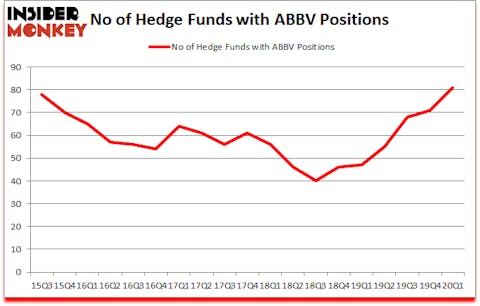

Is AbbVie Inc (NYSE:ABBV) a buy here? The best stock pickers are getting more optimistic. The number of bullish hedge fund bets went up by 10 in recent months. Our calculations also showed that ABBV isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). ABBV was in 81 hedge funds’ portfolios at the end of the first quarter of 2020. There were 71 hedge funds in our database with ABBV holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72% since March 2017 and outperformed the S&P 500 ETFs by more than 44 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we asked astrophysicist Neil deGrasse Tyson about Tesla, Elon Musk, and his top stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s analyze the recent hedge fund action encompassing AbbVie Inc (NYSE:ABBV).

How have hedgies been trading AbbVie Inc (NYSE:ABBV)?

At the end of the first quarter, a total of 81 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ABBV over the last 18 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

The largest stake in AbbVie Inc (NYSE:ABBV) was held by Renaissance Technologies, which reported holding $1032.8 million worth of stock at the end of September. It was followed by Orbis Investment Management with a $1031.6 million position. Other investors bullish on the company included Arrowstreet Capital, Citadel Investment Group, and Farallon Capital. In terms of the portfolio weights assigned to each position Orbis Investment Management allocated the biggest weight to AbbVie Inc (NYSE:ABBV), around 9.82% of its 13F portfolio. Logos Capital is also relatively very bullish on the stock, dishing out 7.7 percent of its 13F equity portfolio to ABBV.

Now, some big names were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, established the most outsized position in AbbVie Inc (NYSE:ABBV). Point72 Asset Management had $106 million invested in the company at the end of the quarter. Stephen DuBois’s Camber Capital Management also initiated a $91.4 million position during the quarter. The following funds were also among the new ABBV investors: Robert Pohly’s Samlyn Capital, Arthur B Cohen and Joseph Healey’s Healthcor Management LP, and Henrik Rhenman’s Rhenman & Partners Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as AbbVie Inc (NYSE:ABBV) but similarly valued. These stocks are Paypal Holdings Inc (NASDAQ:PYPL), ASML Holding N.V. (NASDAQ:ASML), Sanofi (NYSE:SNY), and Accenture Plc (NYSE:ACN). This group of stocks’ market caps match ABBV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PYPL | 118 | 4659097 | -8 |

| ASML | 30 | 1505012 | 8 |

| SNY | 15 | 970814 | -16 |

| ACN | 49 | 1003250 | 8 |

| Average | 53 | 2034543 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 53 hedge funds with bullish positions and the average amount invested in these stocks was $2035 million. That figure was $5118 million in ABBV’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand Sanofi (NYSE:SNY) is the least popular one with only 15 bullish hedge fund positions. AbbVie Inc (NYSE:ABBV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but still beat the market by 15.6 percentage points. Hedge funds were also right about betting on ABBV as the stock returned 22.7% in Q2 (through May 22nd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.