The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Yatra Online, Inc. (NASDAQ:YTRA).

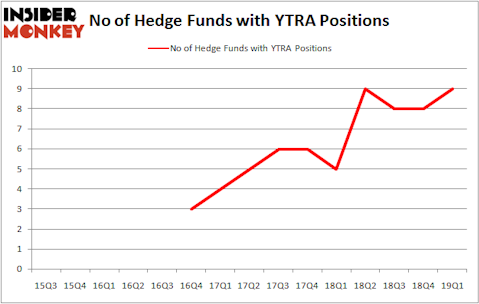

Is Yatra Online, Inc. (NASDAQ:YTRA) the right investment to pursue these days? Investors who are in the know are getting more optimistic. The number of bullish hedge fund positions improved by 1 recently. Our calculations also showed that YTRA isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of methods stock traders use to evaluate their stock investments. A duo of the best methods are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite money managers can beat the broader indices by a superb margin (see the details here).

We’re going to take a gander at the recent hedge fund action regarding Yatra Online, Inc. (NASDAQ:YTRA).

How are hedge funds trading Yatra Online, Inc. (NASDAQ:YTRA)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the previous quarter. By comparison, 5 hedge funds held shares or bullish call options in YTRA a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Altai Capital held the most valuable stake in Yatra Online, Inc. (NASDAQ:YTRA), which was worth $22 million at the end of the first quarter. On the second spot was MAK Capital One which amassed $13.5 million worth of shares. Moreover, Millennium Management, Indus Capital, and Renaissance Technologies were also bullish on Yatra Online, Inc. (NASDAQ:YTRA), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, specific money managers were breaking ground themselves. Springbok Capital, managed by Gavin Saitowitz and Cisco J. del Valle, created the most outsized position in Yatra Online, Inc. (NASDAQ:YTRA). Springbok Capital had $0.1 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $0.1 million position during the quarter.

Let’s go over hedge fund activity in other stocks similar to Yatra Online, Inc. (NASDAQ:YTRA). These stocks are Spero Therapeutics, Inc. (NASDAQ:SPRO), BRT Apartments Corp. (NYSE:BRT), Marinus Pharmaceuticals Inc (NASDAQ:MRNS), and BCB Bancorp, Inc. (NASDAQ:BCBP). This group of stocks’ market caps are similar to YTRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPRO | 7 | 35021 | 2 |

| BRT | 4 | 10406 | 1 |

| MRNS | 10 | 24633 | -2 |

| BCBP | 2 | 6458 | -2 |

| Average | 5.75 | 19130 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $41 million in YTRA’s case. Marinus Pharmaceuticals Inc (NASDAQ:MRNS) is the most popular stock in this table. On the other hand BCB Bancorp, Inc. (NASDAQ:BCBP) is the least popular one with only 2 bullish hedge fund positions. Yatra Online, Inc. (NASDAQ:YTRA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately YTRA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on YTRA were disappointed as the stock returned -18.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.