The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Washington Federal Inc. (NASDAQ:WAFD), and what that likely means for the prospects of the company and its stock.

Is Washington Federal Inc. (NASDAQ:WAFD) a superb investment now? The smart money is taking an optimistic view. The number of long hedge fund bets rose by 3 in recent months. Our calculations also showed that wafd isn’t among the 30 most popular stocks among hedge funds.

Today there are a lot of signals shareholders have at their disposal to appraise publicly traded companies. Some of the best signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the top investment managers can outpace their index-focused peers by a healthy margin (see the details here).

We’re going to analyze the fresh hedge fund action surrounding Washington Federal Inc. (NASDAQ:WAFD).

How have hedgies been trading Washington Federal Inc. (NASDAQ:WAFD)?

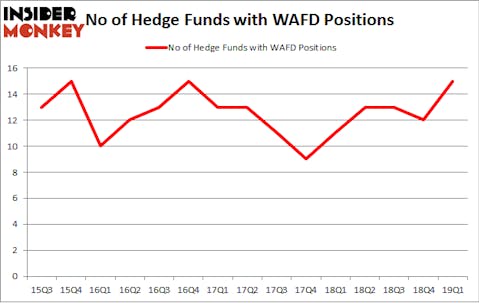

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WAFD over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Washington Federal Inc. (NASDAQ:WAFD), with a stake worth $15.4 million reported as of the end of March. Trailing Renaissance Technologies was Balyasny Asset Management, which amassed a stake valued at $12.4 million. Winton Capital Management, Arrowstreet Capital, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers have jumped into Washington Federal Inc. (NASDAQ:WAFD) headfirst. Winton Capital Management, managed by David Harding, initiated the largest position in Washington Federal Inc. (NASDAQ:WAFD). Winton Capital Management had $11.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $3.2 million position during the quarter. The only other fund with a new position in the stock is Ravi Chopra’s Azora Capital.

Let’s now review hedge fund activity in other stocks similar to Washington Federal Inc. (NASDAQ:WAFD). These stocks are CONMED Corporation (NASDAQ:CNMD), WD-40 Company (NASDAQ:WDFC), Legg Mason, Inc. (NYSE:LM), and SiteOne Landscape Supply, Inc. (NYSE:SITE). This group of stocks’ market valuations match WAFD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNMD | 21 | 257029 | -4 |

| WDFC | 14 | 137108 | -1 |

| LM | 17 | 193646 | -1 |

| SITE | 12 | 42960 | 1 |

| Average | 16 | 157686 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $158 million. That figure was $58 million in WAFD’s case. CONMED Corporation (NASDAQ:CNMD) is the most popular stock in this table. On the other hand SiteOne Landscape Supply, Inc. (NYSE:SITE) is the least popular one with only 12 bullish hedge fund positions. Washington Federal Inc. (NASDAQ:WAFD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on WAFD as the stock returned 16.7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.