After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Warrior Met Coal, Inc. (NYSE:HCC).

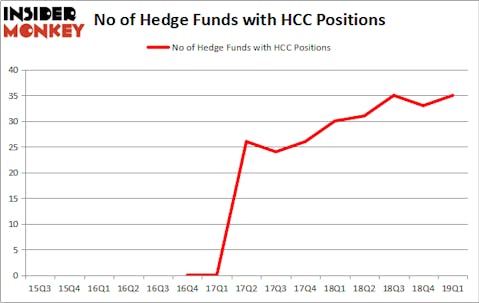

Warrior Met Coal, Inc. (NYSE:HCC) investors should be aware of an increase in hedge fund sentiment lately. Our calculations also showed that HCC isn’t among the 30 most popular stocks among hedge funds.

At the moment there are tons of indicators stock traders can use to appraise their stock investments. Some of the most underrated indicators are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace the broader indices by a superb margin (see the details here).

Let’s analyze the key hedge fund action encompassing Warrior Met Coal, Inc. (NYSE:HCC).

Hedge fund activity in Warrior Met Coal, Inc. (NYSE:HCC)

At the end of the first quarter, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HCC over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Warrior Met Coal, Inc. (NYSE:HCC) was held by Third Avenue Management, which reported holding $55.2 million worth of stock at the end of March. It was followed by Luminus Management with a $52.5 million position. Other investors bullish on the company included Platinum Asset Management, Impala Asset Management, and Lansdowne Partners.

As industrywide interest jumped, some big names have jumped into Warrior Met Coal, Inc. (NYSE:HCC) headfirst. GoldenTree Asset Management, managed by Steven Tananbaum, initiated the biggest position in Warrior Met Coal, Inc. (NYSE:HCC). GoldenTree Asset Management had $9.5 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $4 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Mike Vranos’s Ellington, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks similar to Warrior Met Coal, Inc. (NYSE:HCC). These stocks are Federal Signal Corporation (NYSE:FSS), Redwood Trust, Inc. (NYSE:RWT), Oceaneering International (NYSE:OII), and Ferro Corporation (NYSE:FOE). This group of stocks’ market values resemble HCC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSS | 20 | 71386 | -2 |

| RWT | 15 | 111479 | 3 |

| OII | 21 | 127792 | 5 |

| FOE | 16 | 216138 | -3 |

| Average | 18 | 131699 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $132 million. That figure was $480 million in HCC’s case. Oceaneering International (NYSE:OII) is the most popular stock in this table. On the other hand Redwood Trust, Inc. (NYSE:RWT) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Warrior Met Coal, Inc. (NYSE:HCC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on HCC, though not to the same extent, as the stock returned 0.6% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.