The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Unitil Corporation (NYSE:UTL) based on those filings.

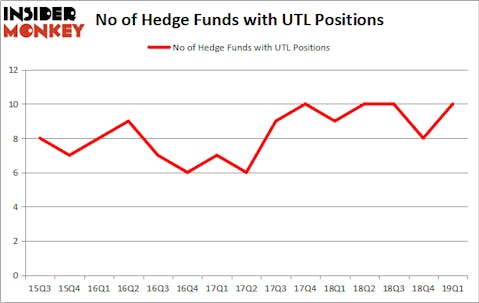

Unitil Corporation (NYSE:UTL) has experienced an increase in activity from the world’s largest hedge funds in recent months. UTL was in 10 hedge funds’ portfolios at the end of March. There were 8 hedge funds in our database with UTL holdings at the end of the previous quarter. Our calculations also showed that UTL isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s check out the latest hedge fund action surrounding Unitil Corporation (NYSE:UTL).

What have hedge funds been doing with Unitil Corporation (NYSE:UTL)?

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 25% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in UTL a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Unitil Corporation (NYSE:UTL), with a stake worth $46.8 million reported as of the end of March. Trailing Renaissance Technologies was Impax Asset Management, which amassed a stake valued at $23.8 million. Adage Capital Management, GLG Partners, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers have jumped into Unitil Corporation (NYSE:UTL) headfirst. Citadel Investment Group, managed by Ken Griffin, established the most outsized position in Unitil Corporation (NYSE:UTL). Citadel Investment Group had $0.3 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.2 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Unitil Corporation (NYSE:UTL). These stocks are PGT Innovations Inc. (NASDAQ:PGTI), Adecoagro SA (NYSE:AGRO), Columbus McKinnon Corporation (NASDAQ:CMCO), and Innovative Industrial Properties, Inc. (NYSE:IIPR). This group of stocks’ market caps are similar to UTL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PGTI | 21 | 100534 | 1 |

| AGRO | 17 | 184647 | 0 |

| CMCO | 21 | 61028 | -4 |

| IIPR | 9 | 18482 | 1 |

| Average | 17 | 91173 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $99 million in UTL’s case. PGT Innovations Inc. (NASDAQ:PGTI) is the most popular stock in this table. On the other hand Innovative Industrial Properties, Inc. (NYSE:IIPR) is the least popular one with only 9 bullish hedge fund positions. Unitil Corporation (NYSE:UTL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on UTL as the stock returned 11.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.