At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

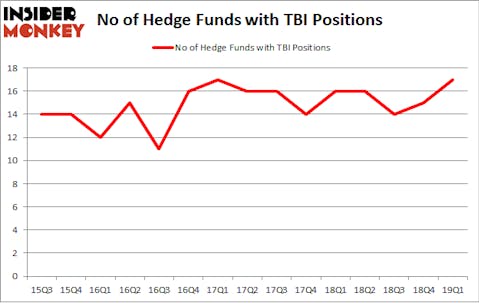

Is Trueblue Inc (NYSE:TBI) a healthy stock for your portfolio? Hedge funds are in an optimistic mood. The number of long hedge fund positions inched up by 2 lately. Our calculations also showed that tbi isn’t among the 30 most popular stocks among hedge funds. TBI was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. There were 15 hedge funds in our database with TBI positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the fresh hedge fund action surrounding Trueblue Inc (NYSE:TBI).

What have hedge funds been doing with Trueblue Inc (NYSE:TBI)?

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in TBI a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, GMT Capital was the largest shareholder of Trueblue Inc (NYSE:TBI), with a stake worth $45.5 million reported as of the end of March. Trailing GMT Capital was AQR Capital Management, which amassed a stake valued at $10.3 million. D E Shaw, Royce & Associates, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most outsized position in Trueblue Inc (NYSE:TBI). Arrowstreet Capital had $2.7 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $0.4 million investment in the stock during the quarter. The other funds with brand new TBI positions are Jeffrey Talpins’s Element Capital Management and Joel Greenblatt’s Gotham Asset Management.

Let’s now review hedge fund activity in other stocks similar to Trueblue Inc (NYSE:TBI). We will take a look at Lantheus Holdings Inc (NASDAQ:LNTH), Ra Pharmaceuticals, Inc. (NASDAQ:RARX), Coherus Biosciences Inc (NASDAQ:CHRS), and CONSOL Energy Inc. (NYSE:CEIX). All of these stocks’ market caps are closest to TBI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LNTH | 18 | 99743 | 1 |

| RARX | 20 | 267787 | 3 |

| CHRS | 27 | 199168 | 7 |

| CEIX | 19 | 130215 | -6 |

| Average | 21 | 174228 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $174 million. That figure was $78 million in TBI’s case. Coherus Biosciences Inc (NASDAQ:CHRS) is the most popular stock in this table. On the other hand Lantheus Holdings Inc (NASDAQ:LNTH) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Trueblue Inc (NYSE:TBI) is even less popular than LNTH. Hedge funds dodged a bullet by taking a bearish stance towards TBI. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately TBI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); TBI investors were disappointed as the stock returned -7.6% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.