We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards TechTarget Inc (NASDAQ:TTGT).

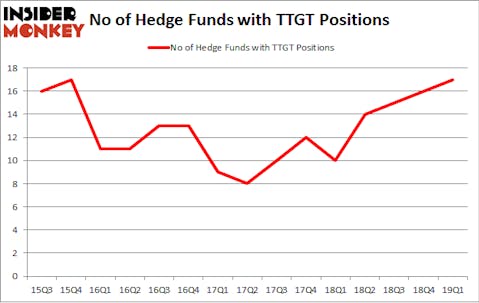

Is TechTarget Inc (NASDAQ:TTGT) a buy here? Investors who are in the know are becoming more confident. The number of long hedge fund positions improved by 1 lately. Our calculations also showed that ttgt isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of tools shareholders employ to evaluate stocks. A pair of the less utilized tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the best investment managers can beat the S&P 500 by a solid margin (see the details here).

Paul Marshall of Marshall Wace

Let’s go over the key hedge fund action surrounding TechTarget Inc (NASDAQ:TTGT).

What does smart money think about TechTarget Inc (NASDAQ:TTGT)?

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the fourth quarter of 2018. On the other hand, there were a total of 10 hedge funds with a bullish position in TTGT a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Nine Ten Partners was the largest shareholder of TechTarget Inc (NASDAQ:TTGT), with a stake worth $27.8 million reported as of the end of March. Trailing Nine Ten Partners was Portolan Capital Management, which amassed a stake valued at $13.6 million. Renaissance Technologies, Marshall Wace LLP, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have been driving this bullishness. Portolan Capital Management, managed by George McCabe, assembled the biggest position in TechTarget Inc (NASDAQ:TTGT). Portolan Capital Management had $13.6 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $0.4 million investment in the stock during the quarter. The following funds were also among the new TTGT investors: Peter Algert and Kevin Coldiron’s Algert Coldiron Investors and Mike Vranos’s Ellington.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as TechTarget Inc (NASDAQ:TTGT) but similarly valued. These stocks are Fly Leasing Ltd (NYSE:FLY), Control4 Corp (NASDAQ:CTRL), Hi-Crush Partners LP (NYSE:HCLP), and Haverty Furniture Companies, Inc. (NYSE:HVT). This group of stocks’ market values match TTGT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLY | 8 | 35906 | -1 |

| CTRL | 17 | 29586 | 5 |

| HCLP | 4 | 1583 | -1 |

| HVT | 11 | 75476 | 1 |

| Average | 10 | 35638 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $83 million in TTGT’s case. Control4 Corp (NASDAQ:CTRL) is the most popular stock in this table. On the other hand Hi-Crush Partners LP (NYSE:HCLP) is the least popular one with only 4 bullish hedge fund positions. TechTarget Inc (NASDAQ:TTGT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on TTGT as the stock returned 30.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.