Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like SurModics, Inc. (NASDAQ:SRDX).

Hedge fund interest in SurModics, Inc. (NASDAQ:SRDX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare SRDX to other stocks including FutureFuel Corp. (NYSE:FF), Plug Power, Inc. (NASDAQ:PLUG), and Mobileiron Inc (NASDAQ:MOBL) to get a better sense of its popularity.

According to most traders, hedge funds are seen as underperforming, old financial tools of yesteryear. While there are greater than 8000 funds with their doors open today, We hone in on the bigwigs of this group, approximately 750 funds. Most estimates calculate that this group of people watch over bulk of the hedge fund industry’s total capital, and by watching their inimitable investments, Insider Monkey has unsheathed a few investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s go over the latest hedge fund action regarding SurModics, Inc. (NASDAQ:SRDX).

What have hedge funds been doing with SurModics, Inc. (NASDAQ:SRDX)?

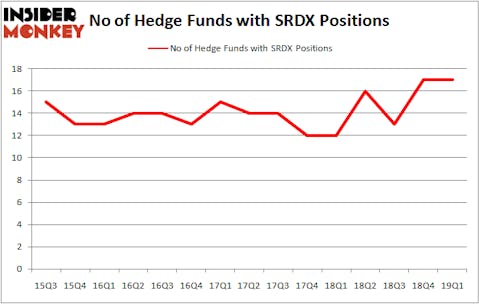

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in SRDX a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in SurModics, Inc. (NASDAQ:SRDX) was held by Renaissance Technologies, which reported holding $46 million worth of stock at the end of March. It was followed by Trigran Investments with a $35 million position. Other investors bullish on the company included Royce & Associates, AQR Capital Management, and Millennium Management.

Seeing as SurModics, Inc. (NASDAQ:SRDX) has faced bearish sentiment from the aggregate hedge fund industry, we can see that there exists a select few money managers that decided to sell off their full holdings last quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group sold off the biggest position of the 700 funds watched by Insider Monkey, comprising close to $0.6 million in stock, and David Harding’s Winton Capital Management was right behind this move, as the fund cut about $0.4 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as SurModics, Inc. (NASDAQ:SRDX) but similarly valued. We will take a look at FutureFuel Corp. (NYSE:FF), Plug Power, Inc. (NASDAQ:PLUG), Mobileiron Inc (NASDAQ:MOBL), and The Manitowoc Company, Inc. (NYSE:MTW). All of these stocks’ market caps are closest to SRDX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FF | 15 | 53636 | 1 |

| PLUG | 7 | 43583 | 1 |

| MOBL | 17 | 126183 | 1 |

| MTW | 20 | 113807 | 6 |

| Average | 14.75 | 84302 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $84 million. That figure was $129 million in SRDX’s case. The Manitowoc Company, Inc. (NYSE:MTW) is the most popular stock in this table. On the other hand Plug Power, Inc. (NASDAQ:PLUG) is the least popular one with only 7 bullish hedge fund positions. SurModics, Inc. (NASDAQ:SRDX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SRDX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SRDX were disappointed as the stock returned -5.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.