You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Hedge fund interest in Sierra Oncology, Inc. (NASDAQ:SRRA) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Trinity Place Holdings Inc. (NYSE:TPHS), China Online Education Group (NYSE:COE), and Nymox Pharmaceutical Corporation (NASDAQ:NYMX) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the key hedge fund action regarding Sierra Oncology, Inc. (NASDAQ:SRRA).

What does smart money think about Sierra Oncology, Inc. (NASDAQ:SRRA)?

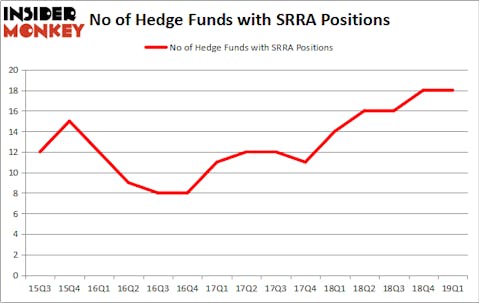

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SRRA over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Alan Frazier’s Frazier Healthcare Partners has the largest position in Sierra Oncology, Inc. (NASDAQ:SRRA), worth close to $13.9 million, amounting to 3.3% of its total 13F portfolio. Sitting at the No. 2 spot is Broadfin Capital, managed by Kevin Kotler, which holds a $8.3 million position; 1.7% of its 13F portfolio is allocated to the stock. Some other professional money managers that hold long positions comprise Nathaniel August’s Mangrove Partners, Joseph Edelman’s Perceptive Advisors and Lawrence Hawkins’s Prosight Capital.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s go over hedge fund activity in other stocks similar to Sierra Oncology, Inc. (NASDAQ:SRRA). We will take a look at Trinity Place Holdings Inc. (NYSE:TPHS), China Online Education Group (NYSE:COE), Nymox Pharmaceutical Corporation (NASDAQ:NYMX), and Internap Corporation (NASDAQ:INAP). This group of stocks’ market caps are similar to SRRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPHS | 7 | 56619 | 0 |

| COE | 4 | 4404 | 1 |

| NYMX | 1 | 46 | 0 |

| INAP | 8 | 32109 | -6 |

| Average | 5 | 23295 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $23 million. That figure was $61 million in SRRA’s case. Internap Corporation (NASDAQ:INAP) is the most popular stock in this table. On the other hand Nymox Pharmaceutical Corporation (NASDAQ:NYMX) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Sierra Oncology, Inc. (NASDAQ:SRRA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SRRA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SRRA were disappointed as the stock returned -61.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.