Is OptimizeRx Corporation (NASDAQ:OPRX) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

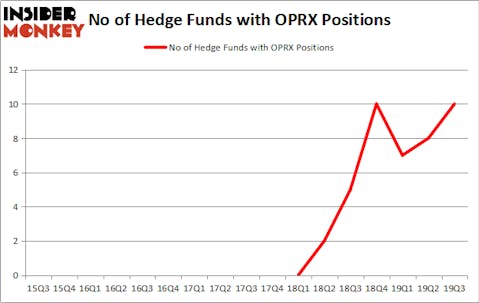

OptimizeRx Corporation (NASDAQ:OPRX) was in 10 hedge funds’ portfolios at the end of the third quarter of 2019. OPRX investors should pay attention to an increase in enthusiasm from smart money lately. There were 8 hedge funds in our database with OPRX holdings at the end of the previous quarter. Our calculations also showed that OPRX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are perceived as slow, old investment vehicles of yesteryear. While there are greater than 8000 funds trading at present, We look at the leaders of this club, about 750 funds. These investment experts direct bulk of the hedge fund industry’s total capital, and by following their highest performing stock picks, Insider Monkey has discovered various investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Richard Driehaus of Driehaus Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the latest hedge fund action regarding OptimizeRx Corporation (NASDAQ:OPRX).

How have hedgies been trading OptimizeRx Corporation (NASDAQ:OPRX)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. By comparison, 5 hedge funds held shares or bullish call options in OPRX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Peter S. Park’s Park West Asset Management has the largest position in OptimizeRx Corporation (NASDAQ:OPRX), worth close to $15.6 million, amounting to 0.8% of its total 13F portfolio. Sitting at the No. 2 spot is Josh Goldberg of G2 Investment Partners Management, with a $9.6 million position; the fund has 2.7% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish comprise Brandon Osten’s Venator Capital Management, Mark Broach’s Manatuck Hill Partners and Richard Driehaus’s Driehaus Capital. In terms of the portfolio weights assigned to each position G2 Investment Partners Management allocated the biggest weight to OptimizeRx Corporation (NASDAQ:OPRX), around 2.73% of its 13F portfolio. Venator Capital Management is also relatively very bullish on the stock, setting aside 2.53 percent of its 13F equity portfolio to OPRX.

Consequently, key money managers were leading the bulls’ herd. P.A.W. Capital Partners, managed by Peter A. Wright, initiated the biggest position in OptimizeRx Corporation (NASDAQ:OPRX). P.A.W. Capital Partners had $0.6 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.3 million position during the quarter. The other funds with brand new OPRX positions are Cliff Asness’s AQR Capital Management, David Harding’s Winton Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks similar to OptimizeRx Corporation (NASDAQ:OPRX). These stocks are Castlight Health Inc (NYSE:CSLT), Alexco Resource Corp. (NYSEAMERICAN:AXU), Bicycle Therapeutics plc (NASDAQ:BCYC), and KLX Energy Services Holdings, Inc. (NASDAQ:KLXE). This group of stocks’ market values resemble OPRX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSLT | 19 | 21185 | 3 |

| AXU | 3 | 3146 | -2 |

| BCYC | 6 | 34158 | -1 |

| KLXE | 13 | 20213 | 5 |

| Average | 10.25 | 19676 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $33 million in OPRX’s case. Castlight Health Inc (NYSE:CSLT) is the most popular stock in this table. On the other hand Alexco Resource Corp. (NYSEAMERICAN:AXU) is the least popular one with only 3 bullish hedge fund positions. OptimizeRx Corporation (NASDAQ:OPRX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately OPRX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); OPRX investors were disappointed as the stock returned -26.1% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.