Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

NICE Ltd. (NASDAQ:NICE) has experienced an increase in hedge fund interest in recent months. Our calculations also showed that NICE isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are tons of tools market participants use to evaluate stocks. A duo of the most under-the-radar tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outpace the market by a solid margin (see the details here).

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the key hedge fund action encompassing NICE Ltd. (NASDAQ:NICE).

What have hedge funds been doing with NICE Ltd. (NASDAQ:NICE)?

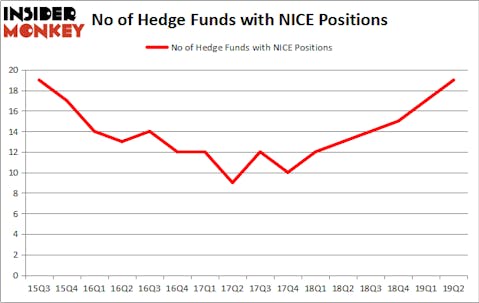

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NICE over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in NICE Ltd. (NASDAQ:NICE) was held by RGM Capital, which reported holding $94.9 million worth of stock at the end of March. It was followed by Arrowstreet Capital with a $73.9 million position. Other investors bullish on the company included Driehaus Capital, Millennium Management, and Arrowgrass Capital Partners.

As aggregate interest increased, key money managers have been driving this bullishness. McKinley Capital Management, managed by Robert B. Gillam, created the largest position in NICE Ltd. (NASDAQ:NICE). McKinley Capital Management had $27.3 million invested in the company at the end of the quarter. Spencer M. Waxman’s Shannon River Fund Management also initiated a $7.2 million position during the quarter. The following funds were also among the new NICE investors: D. E. Shaw’s D E Shaw, Benjamin A. Smith’s Laurion Capital Management, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as NICE Ltd. (NASDAQ:NICE) but similarly valued. These stocks are Aspen Technology, Inc. (NASDAQ:AZPN), F5 Networks, Inc. (NASDAQ:FFIV), Euronet Worldwide, Inc. (NASDAQ:EEFT), and The Western Union Company (NYSE:WU). All of these stocks’ market caps match NICE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AZPN | 26 | 1272257 | 1 |

| FFIV | 23 | 1083984 | -1 |

| EEFT | 33 | 409978 | 0 |

| WU | 23 | 383896 | 3 |

| Average | 26.25 | 787529 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $788 million. That figure was $382 million in NICE’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand F5 Networks, Inc. (NASDAQ:FFIV) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks NICE Ltd. (NASDAQ:NICE) is even less popular than FFIV. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on NICE, though not to the same extent, as the stock returned 5% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.