Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 8 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Lakeland Bancorp, Inc. (NASDAQ:LBAI).

Hedge fund interest in Lakeland Bancorp, Inc. (NASDAQ:LBAI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as TrustCo Bank Corp NY (NASDAQ:TRST), Ameresco Inc (NYSE:AMRC), and Oritani Financial Corp. (NASDAQ:ORIT) to gather more data points.

If you’d ask most market participants, hedge funds are perceived as slow, old investment vehicles of the past. While there are over 8000 funds trading today, Our researchers choose to focus on the top tier of this group, approximately 750 funds. Most estimates calculate that this group of people orchestrate the lion’s share of all hedge funds’ total asset base, and by watching their top picks, Insider Monkey has discovered several investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to view the fresh hedge fund action regarding Lakeland Bancorp, Inc. (NASDAQ:LBAI).

How have hedgies been trading Lakeland Bancorp, Inc. (NASDAQ:LBAI)?

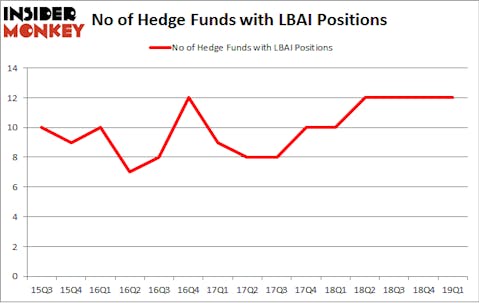

Heading into the second quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LBAI over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Cardinal Capital held the most valuable stake in Lakeland Bancorp, Inc. (NASDAQ:LBAI), which was worth $34.7 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $12.4 million worth of shares. Moreover, Basswood Capital, Millennium Management, and Marshall Wace LLP were also bullish on Lakeland Bancorp, Inc. (NASDAQ:LBAI), allocating a large percentage of their portfolios to this stock.

Seeing as Lakeland Bancorp, Inc. (NASDAQ:LBAI) has faced a decline in interest from the smart money, it’s safe to say that there were a few funds that decided to sell off their full holdings in the third quarter. At the top of the heap, Anton Schutz’s Mendon Capital Advisors sold off the largest stake of all the hedgies monitored by Insider Monkey, worth about $4 million in stock. Peter Algert and Kevin Coldiron’s fund, Algert Coldiron Investors, also said goodbye to its stock, about $0.2 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Lakeland Bancorp, Inc. (NASDAQ:LBAI). We will take a look at TrustCo Bank Corp NY (NASDAQ:TRST), Ameresco Inc (NYSE:AMRC), Oritani Financial Corp. (NASDAQ:ORIT), and Meridian Bioscience, Inc. (NASDAQ:VIVO). This group of stocks’ market values match LBAI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRST | 10 | 46536 | 1 |

| AMRC | 10 | 30678 | 3 |

| ORIT | 7 | 36842 | -1 |

| VIVO | 16 | 83869 | -2 |

| Average | 10.75 | 49481 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $58 million in LBAI’s case. Meridian Bioscience, Inc. (NASDAQ:VIVO) is the most popular stock in this table. On the other hand Oritani Financial Corp. (NASDAQ:ORIT) is the least popular one with only 7 bullish hedge fund positions. Lakeland Bancorp, Inc. (NASDAQ:LBAI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on LBAI, though not to the same extent, as the stock returned 5.1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.