Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of L.B. Foster Company (NASDAQ:FSTR) based on that data.

Is L.B. Foster Company (NASDAQ:FSTR) a good stock to buy now? Investors who are in the know are turning bullish. The number of bullish hedge fund positions inched up by 3 recently. Our calculations also showed that FSTR isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the key hedge fund action regarding L.B. Foster Company (NASDAQ:FSTR).

What does smart money think about L.B. Foster Company (NASDAQ:FSTR)?

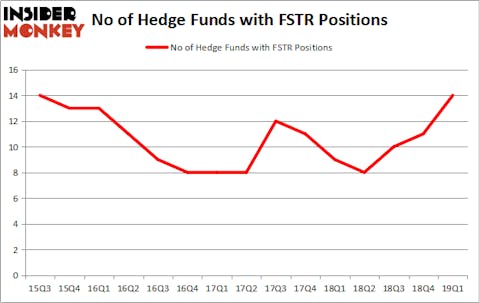

At the end of the first quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 27% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards FSTR over the last 15 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, Legion Partners Asset Management was the largest shareholder of L.B. Foster Company (NASDAQ:FSTR), with a stake worth $19.8 million reported as of the end of March. Trailing Legion Partners Asset Management was Renaissance Technologies, which amassed a stake valued at $10.8 million. D E Shaw, Minerva Advisors, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Minerva Advisors, managed by David P. Cohen, assembled the largest position in L.B. Foster Company (NASDAQ:FSTR). Minerva Advisors had $1.9 million invested in the company at the end of the quarter. Peter Schliemann’s Rutabaga Capital Management also initiated a $1.4 million position during the quarter. The only other fund with a brand new FSTR position is Noam Gottesman’s GLG Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as L.B. Foster Company (NASDAQ:FSTR) but similarly valued. We will take a look at Mesa Air Group, Inc. (NASDAQ:MESA), MIDSTATES PETROLEUM COMPANY, INC. (NYSE:MPO), Red Lion Hotels Corporation (NYSE:RLH), and NII Holdings, Inc. (NASDAQ:NIHD). This group of stocks’ market valuations are closest to FSTR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MESA | 17 | 54218 | 6 |

| MPO | 18 | 97613 | -1 |

| RLH | 11 | 58120 | -1 |

| NIHD | 14 | 40636 | -4 |

| Average | 15 | 62647 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $43 million in FSTR’s case. MIDSTATES PETROLEUM COMPANY, INC. (NYSE:MPO) is the most popular stock in this table. On the other hand Red Lion Hotels Corporation (NYSE:RLH) is the least popular one with only 11 bullish hedge fund positions. L.B. Foster Company (NASDAQ:FSTR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on FSTR as the stock returned 26.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.