You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Hedge fund interest in Kadant Inc. (NYSE:KAI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as GoPro Inc (NASDAQ:GPRO), Scorpio Tankers Inc. (NYSE:STNG), and Sangamo Therapeutics, Inc. (NASDAQ:SGMO) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the new hedge fund action surrounding Kadant Inc. (NYSE:KAI).

Hedge fund activity in Kadant Inc. (NYSE:KAI)

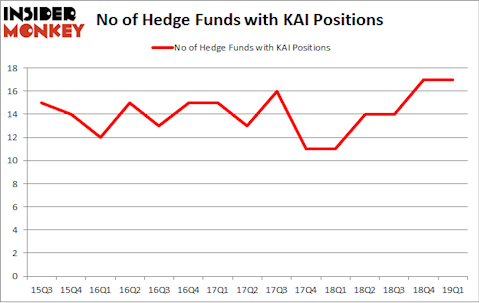

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. By comparison, 11 hedge funds held shares or bullish call options in KAI a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in Kadant Inc. (NYSE:KAI), which was worth $51.8 million at the end of the first quarter. On the second spot was Millennium Management which amassed $11.6 million worth of shares. Moreover, Renaissance Technologies, Driehaus Capital, and Citadel Investment Group were also bullish on Kadant Inc. (NYSE:KAI), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: GLG Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Arrowstreet Capital).

Let’s now take a look at hedge fund activity in other stocks similar to Kadant Inc. (NYSE:KAI). We will take a look at GoPro Inc (NASDAQ:GPRO), Scorpio Tankers Inc. (NYSE:STNG), Sangamo Therapeutics, Inc. (NASDAQ:SGMO), and MTS Systems Corporation (NASDAQ:MTSC). This group of stocks’ market values match KAI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPRO | 23 | 183454 | 10 |

| STNG | 18 | 118474 | 8 |

| SGMO | 19 | 41872 | -4 |

| MTSC | 10 | 126200 | -2 |

| Average | 17.5 | 117500 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $118 million. That figure was $93 million in KAI’s case. GoPro Inc (NASDAQ:GPRO) is the most popular stock in this table. On the other hand MTS Systems Corporation (NASDAQ:MTSC) is the least popular one with only 10 bullish hedge fund positions. Kadant Inc. (NYSE:KAI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately KAI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); KAI investors were disappointed as the stock returned 3.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.