World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

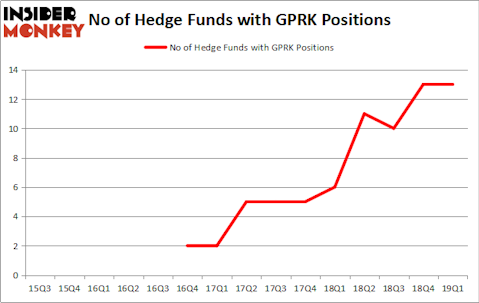

Geopark Ltd (NYSE:GPRK) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare GPRK to other stocks including Endurance International Group Holdings Inc (NASDAQ:EIGI), Lindsay Corporation (NYSE:LNN), and Kenon Holdings Ltd. (NYSE:KEN) to get a better sense of its popularity.

According to most stock holders, hedge funds are perceived as worthless, outdated financial tools of years past. While there are greater than 8000 funds trading today, Our experts hone in on the crème de la crème of this club, around 750 funds. It is estimated that this group of investors command the majority of the smart money’s total capital, and by monitoring their matchless investments, Insider Monkey has deciphered a number of investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the fresh hedge fund action encompassing Geopark Ltd (NYSE:GPRK).

Hedge fund activity in Geopark Ltd (NYSE:GPRK)

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. By comparison, 6 hedge funds held shares or bullish call options in GPRK a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Geopark Ltd (NYSE:GPRK) was held by Renaissance Technologies, which reported holding $67 million worth of stock at the end of March. It was followed by Driehaus Capital with a $5.7 million position. Other investors bullish on the company included Navellier & Associates, D E Shaw, and Two Sigma Advisors.

Seeing as Geopark Ltd (NYSE:GPRK) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of hedge funds who sold off their entire stakes heading into Q3. It’s worth mentioning that Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dumped the biggest position of the 700 funds followed by Insider Monkey, valued at close to $0.4 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund sold off about $0.3 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Geopark Ltd (NYSE:GPRK). These stocks are Endurance International Group Holdings Inc (NASDAQ:EIGI), Lindsay Corporation (NYSE:LNN), Kenon Holdings Ltd. (NYSE:KEN), and Boise Cascade Co (NYSE:BCC). This group of stocks’ market values are closest to GPRK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EIGI | 11 | 125661 | -7 |

| LNN | 7 | 212046 | -4 |

| KEN | 2 | 1118 | 1 |

| BCC | 13 | 38900 | -2 |

| Average | 8.25 | 94431 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $94 million. That figure was $88 million in GPRK’s case. Boise Cascade Co (NYSE:BCC) is the most popular stock in this table. On the other hand Kenon Holdings Ltd. (NYSE:KEN) is the least popular one with only 2 bullish hedge fund positions. Geopark Ltd (NYSE:GPRK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on GPRK as the stock returned 7.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.