“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Enterprise Financial Services Corp (NASDAQ:EFSC).

Hedge fund interest in Enterprise Financial Services Corp (NASDAQ:EFSC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as M/A-COM Technology Solutions Holdings (NASDAQ:MTSI), Canadian Solar Inc. (NASDAQ:CSIQ), and New Mountain Finance Corp. (NYSE:NMFC) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the recent hedge fund action regarding Enterprise Financial Services Corp (NASDAQ:EFSC).

What have hedge funds been doing with Enterprise Financial Services Corp (NASDAQ:EFSC)?

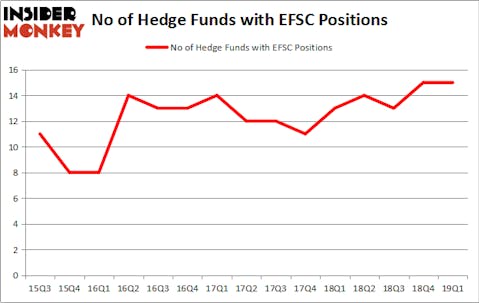

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in EFSC over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in Enterprise Financial Services Corp (NASDAQ:EFSC), worth close to $20 million, comprising less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Elizabeth Park Capital Management, managed by Fred Cummings, which holds a $11.7 million position; 4.7% of its 13F portfolio is allocated to the stock. Other peers that hold long positions contain Paul Marshall and Ian Wace’s Marshall Wace LLP, Ken Griffin’s Citadel Investment Group and Brian Ashford-Russell and Tim Woolley’s Polar Capital.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: HBK Investments. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was ExodusPoint Capital).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Enterprise Financial Services Corp (NASDAQ:EFSC) but similarly valued. These stocks are MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI), Canadian Solar Inc. (NASDAQ:CSIQ), New Mountain Finance Corp. (NYSE:NMFC), and Pacific Biosciences of California, Inc. (NASDAQ:PACB). All of these stocks’ market caps match EFSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTSI | 16 | 134289 | 1 |

| CSIQ | 11 | 122280 | 0 |

| NMFC | 9 | 26087 | -2 |

| PACB | 19 | 241025 | -2 |

| Average | 13.75 | 130920 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $131 million. That figure was $53 million in EFSC’s case. Pacific Biosciences of California, Inc. (NASDAQ:PACB) is the most popular stock in this table. On the other hand New Mountain Finance Corp. (NYSE:NMFC) is the least popular one with only 9 bullish hedge fund positions. Enterprise Financial Services Corp (NASDAQ:EFSC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately EFSC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EFSC were disappointed as the stock returned 1.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.