How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Dorman Products Inc. (NASDAQ:DORM).

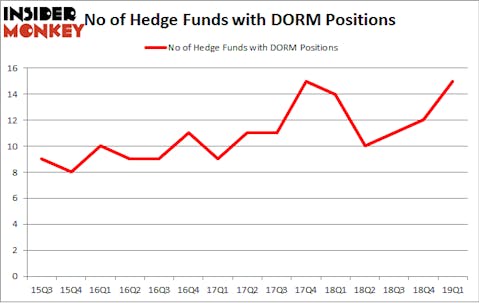

Dorman Products Inc. (NASDAQ:DORM) was in 15 hedge funds’ portfolios at the end of March. DORM has experienced an increase in activity from the world’s largest hedge funds lately. There were 12 hedge funds in our database with DORM holdings at the end of the previous quarter. Our calculations also showed that dorm isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are viewed as slow, outdated financial tools of yesteryear. While there are more than 8000 funds with their doors open today, Our researchers choose to focus on the crème de la crème of this club, around 750 funds. These investment experts oversee the lion’s share of the smart money’s total asset base, and by following their first-class picks, Insider Monkey has uncovered a number of investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Sander Gerber of Hudson Bay Capital

We’re going to take a peek at the recent hedge fund action surrounding Dorman Products Inc. (NASDAQ:DORM).

What have hedge funds been doing with Dorman Products Inc. (NASDAQ:DORM)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from one quarter earlier. By comparison, 14 hedge funds held shares or bullish call options in DORM a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in Dorman Products Inc. (NASDAQ:DORM), which was worth $52.1 million at the end of the first quarter. On the second spot was Hudson Bay Capital Management which amassed $3.8 million worth of shares. Moreover, Third Avenue Management, Minerva Advisors, and Horizon Asset Management were also bullish on Dorman Products Inc. (NASDAQ:DORM), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, specific money managers have been driving this bullishness. Hudson Bay Capital Management, managed by Sander Gerber, assembled the most outsized position in Dorman Products Inc. (NASDAQ:DORM). Hudson Bay Capital Management had $3.8 million invested in the company at the end of the quarter. David P. Cohen’s Minerva Advisors also made a $2.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Hoon Kim’s Quantinno Capital, and David Harding’s Winton Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Dorman Products Inc. (NASDAQ:DORM) but similarly valued. These stocks are Cleveland-Cliffs Inc (NYSE:CLF), NuStar Energy L.P. (NYSE:NS), Trinity Industries, Inc. (NYSE:TRN), and John Bean Technologies Corporation (NYSE:JBT). This group of stocks’ market valuations are similar to DORM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLF | 35 | 464839 | 6 |

| NS | 1 | 1376 | -1 |

| TRN | 28 | 700327 | 1 |

| JBT | 9 | 89833 | 0 |

| Average | 18.25 | 314094 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $314 million. That figure was $72 million in DORM’s case. Cleveland-Cliffs Inc (NYSE:CLF) is the most popular stock in this table. On the other hand NuStar Energy L.P. (NYSE:NS) is the least popular one with only 1 bullish hedge fund positions. Dorman Products Inc. (NASDAQ:DORM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately DORM wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); DORM investors were disappointed as the stock returned -2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.