World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

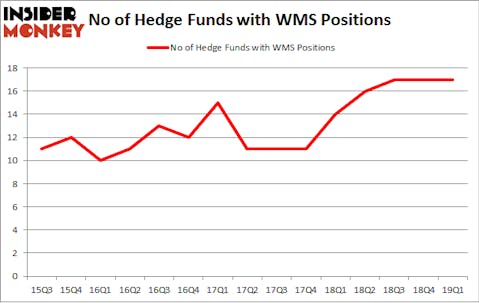

Advanced Drainage Systems, Inc. (NYSE:WMS) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare WMS to other stocks including Heartland Financial USA Inc (NASDAQ:HTLF), Ship Finance International Limited (NYSE:SFL), and Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

We’re going to take a peek at the new hedge fund action encompassing Advanced Drainage Systems, Inc. (NYSE:WMS).

How have hedgies been trading Advanced Drainage Systems, Inc. (NYSE:WMS)?

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in WMS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Stockbridge Partners held the most valuable stake in Advanced Drainage Systems, Inc. (NYSE:WMS), which was worth $96.8 million at the end of the first quarter. On the second spot was Impax Asset Management which amassed $94.9 million worth of shares. Moreover, ACK Asset Management, Marshall Wace LLP, and D E Shaw were also bullish on Advanced Drainage Systems, Inc. (NYSE:WMS), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Advanced Drainage Systems, Inc. (NYSE:WMS) has experienced bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few hedgies that decided to sell off their entire stakes heading into Q3. Intriguingly, Paul Reeder and Edward Shapiro’s PAR Capital Management sold off the biggest stake of the “upper crust” of funds monitored by Insider Monkey, totaling close to $66.4 million in stock. Peter Algert and Kevin Coldiron’s fund, Algert Coldiron Investors, also said goodbye to its stock, about $0.7 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Advanced Drainage Systems, Inc. (NYSE:WMS) but similarly valued. We will take a look at Heartland Financial USA Inc (NASDAQ:HTLF), Ship Finance International Limited (NYSE:SFL), Kulicke and Soffa Industries Inc. (NASDAQ:KLIC), and Bloom Energy Corporation (NYSE:BE). All of these stocks’ market caps match WMS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HTLF | 8 | 24084 | 1 |

| SFL | 6 | 35658 | -6 |

| KLIC | 17 | 199631 | -2 |

| BE | 9 | 15163 | 1 |

| Average | 10 | 68634 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $69 million. That figure was $273 million in WMS’s case. Kulicke and Soffa Industries Inc. (NASDAQ:KLIC) is the most popular stock in this table. On the other hand Ship Finance International Limited (NYSE:SFL) is the least popular one with only 6 bullish hedge fund positions. Advanced Drainage Systems, Inc. (NYSE:WMS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on WMS as the stock returned 26.2% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.