Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: ADTRAN, Inc. (NASDAQ:ADTN).

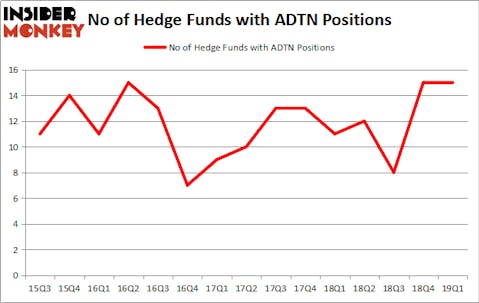

ADTRAN, Inc. (NASDAQ:ADTN) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 15 hedge funds’ portfolios at the end of March. At the end of this article we will also compare ADTN to other stocks including Thoratec Corporation (NASDAQ:THOR), Sohu.com Inc (NASDAQ:SOHU), and Camden National Corporation (NASDAQ:CAC) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s review the fresh hedge fund action surrounding ADTRAN, Inc. (NASDAQ:ADTN).

What does smart money think about ADTRAN, Inc. (NASDAQ:ADTN)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in ADTN a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in ADTRAN, Inc. (NASDAQ:ADTN), which was worth $26.5 million at the end of the first quarter. On the second spot was Millennium Management which amassed $12.1 million worth of shares. Moreover, Arrowstreet Capital, D E Shaw, and Royce & Associates were also bullish on ADTRAN, Inc. (NASDAQ:ADTN), allocating a large percentage of their portfolios to this stock.

Since ADTRAN, Inc. (NASDAQ:ADTN) has witnessed bearish sentiment from hedge fund managers, logic holds that there exists a select few funds that slashed their entire stakes by the end of the third quarter. Intriguingly, David Harding’s Winton Capital Management sold off the biggest position of all the hedgies monitored by Insider Monkey, valued at an estimated $3.1 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also dropped its stock, about $0.4 million worth. These moves are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as ADTRAN, Inc. (NASDAQ:ADTN) but similarly valued. These stocks are Synthorx, Inc. (NASDAQ:THOR), Sohu.com Limited (NASDAQ:SOHU), Camden National Corporation (NASDAQ:CAC), and OrthoPediatrics Corp. (NASDAQ:KIDS). This group of stocks’ market caps match ADTN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| THOR | 5 | 347248 | 0 |

| SOHU | 9 | 88786 | -1 |

| CAC | 6 | 65590 | 0 |

| KIDS | 8 | 38763 | 3 |

| Average | 7 | 135097 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $135 million. That figure was $73 million in ADTN’s case. Sohu.com Limited (NASDAQ:SOHU) is the most popular stock in this table. On the other hand Synthorx, Inc. (NASDAQ:THOR) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks ADTRAN, Inc. (NASDAQ:ADTN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on ADTN as the stock returned 21.2% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.