Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

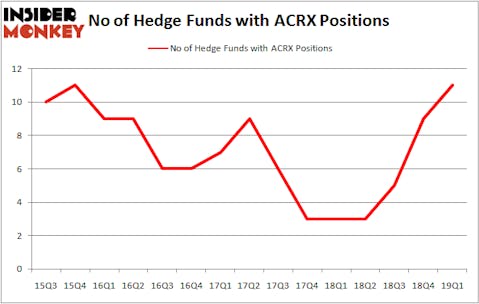

AcelRx Pharmaceuticals Inc (NASDAQ:ACRX) was in 11 hedge funds’ portfolios at the end of March. ACRX has experienced an increase in hedge fund interest lately. There were 9 hedge funds in our database with ACRX holdings at the end of the previous quarter. Our calculations also showed that ACRX isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of gauges stock traders employ to analyze publicly traded companies. A couple of the most under-the-radar gauges are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the top money managers can beat the broader indices by a very impressive margin (see the details here).

Let’s take a gander at the key hedge fund action encompassing AcelRx Pharmaceuticals Inc (NASDAQ:ACRX).

What does smart money think about AcelRx Pharmaceuticals Inc (NASDAQ:ACRX)?

Heading into the second quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from the fourth quarter of 2018. By comparison, 3 hedge funds held shares or bullish call options in ACRX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Millennium Management was the largest shareholder of AcelRx Pharmaceuticals Inc (NASDAQ:ACRX), with a stake worth $3 million reported as of the end of March. Trailing Millennium Management was Laurion Capital Management, which amassed a stake valued at $2.9 million. D E Shaw, Moore Global Investments, and ExodusPoint Capital were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, assembled the biggest position in AcelRx Pharmaceuticals Inc (NASDAQ:ACRX). Citadel Investment Group had $0.4 million invested in the company at the end of the quarter. Andrew Weiss’s Weiss Asset Management also initiated a $0.1 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as AcelRx Pharmaceuticals Inc (NASDAQ:ACRX) but similarly valued. We will take a look at Atlantic Power Corp (NYSE:AT), Hurco Companies, Inc. (NASDAQ:HURC), Scorpio Bulkers Inc (NYSE:SALT), and Atento SA (NYSE:ATTO). This group of stocks’ market caps match ACRX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AT | 12 | 32454 | 5 |

| HURC | 7 | 51858 | -2 |

| SALT | 7 | 16478 | -2 |

| ATTO | 9 | 6383 | 0 |

| Average | 8.75 | 26793 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $10 million in ACRX’s case. Atlantic Power Corp (NYSE:AT) is the most popular stock in this table. On the other hand Hurco Companies, Inc. (NASDAQ:HURC) is the least popular one with only 7 bullish hedge fund positions. AcelRx Pharmaceuticals Inc (NASDAQ:ACRX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ACRX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ACRX were disappointed as the stock returned -30.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.