The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 28 holdings, data that is available nowhere else. Should you consider Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

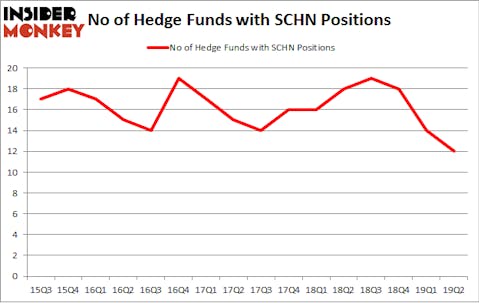

Is Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) the right investment to pursue these days? Prominent investors are selling. The number of bullish hedge fund bets shrunk by 2 recently. Our calculations also showed that SCHN isn’t among the 30 most popular stocks among hedge funds (see the video below). SCHN was in 12 hedge funds’ portfolios at the end of June. There were 14 hedge funds in our database with SCHN positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most shareholders, hedge funds are perceived as underperforming, outdated financial vehicles of the past. While there are greater than 8000 funds in operation at present, Our researchers look at the aristocrats of this group, around 750 funds. These hedge fund managers orchestrate bulk of all hedge funds’ total capital, and by watching their matchless stock picks, Insider Monkey has discovered a number of investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the key hedge fund action encompassing Schnitzer Steel Industries, Inc. (NASDAQ:SCHN).

Hedge fund activity in Schnitzer Steel Industries, Inc. (NASDAQ:SCHN)

At the end of the second quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SCHN over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies has the largest position in Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), worth close to $7.5 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Marshall Wace LLP, led by Paul Marshall and Ian Wace, holding a $4.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Cliff Asness’s AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Chuck Royce’s Royce & Associates.

Judging by the fact that Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies who sold off their positions entirely last quarter. It’s worth mentioning that Paul Tudor Jones’s Tudor Investment Corp sold off the biggest stake of the 750 funds followed by Insider Monkey, totaling about $0.4 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also cut its stock, about $0.1 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Schnitzer Steel Industries, Inc. (NASDAQ:SCHN). We will take a look at United Financial Bancorp, Inc. (NASDAQ:UBNK), Capstead Mortgage Corporation (NYSE:CMO), Monotype Imaging Holdings Inc. (NASDAQ:TYPE), and Allegiance Bancshares, Inc. (NASDAQ:ABTX). This group of stocks’ market valuations are similar to SCHN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBNK | 9 | 70766 | 1 |

| CMO | 9 | 26655 | 1 |

| TYPE | 19 | 172272 | -2 |

| ABTX | 6 | 20638 | -1 |

| Average | 10.75 | 72583 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $29 million in SCHN’s case. Monotype Imaging Holdings Inc. (NASDAQ:TYPE) is the most popular stock in this table. On the other hand Allegiance Bancshares, Inc. (NASDAQ:ABTX) is the least popular one with only 6 bullish hedge fund positions. Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SCHN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SCHN were disappointed as the stock returned -20.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.