Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether CRH PLC (NYSE:CRH) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

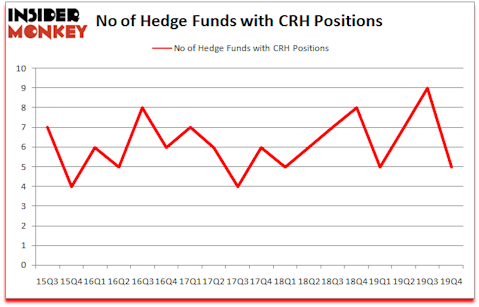

CRH PLC (NYSE:CRH) was in 5 hedge funds’ portfolios at the end of the fourth quarter of 2019. CRH investors should pay attention to a decrease in hedge fund sentiment lately. There were 9 hedge funds in our database with CRH positions at the end of the previous quarter. Our calculations also showed that CRH isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind we’re going to take a peek at the latest hedge fund action surrounding CRH PLC (NYSE:CRH).

Hedge fund activity in CRH PLC (NYSE:CRH)

Heading into the first quarter of 2020, a total of 5 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -44% from the third quarter of 2019. By comparison, 8 hedge funds held shares or bullish call options in CRH a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CRH PLC (NYSE:CRH) was held by Renaissance Technologies, which reported holding $85.8 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $78.1 million position. Other investors bullish on the company included GMT Capital, Sirios Capital Management, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position GMT Capital allocated the biggest weight to CRH PLC (NYSE:CRH), around 0.61% of its 13F portfolio. Arrowstreet Capital is also relatively very bullish on the stock, dishing out 0.18 percent of its 13F equity portfolio to CRH.

Seeing as CRH PLC (NYSE:CRH) has faced declining sentiment from the smart money, we can see that there lies a certain “tier” of hedgies who sold off their entire stakes heading into Q4. Interestingly, Israel Englander’s Millennium Management said goodbye to the largest position of all the hedgies followed by Insider Monkey, comprising close to $6.7 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund sold off about $5.8 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds heading into Q4.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as CRH PLC (NYSE:CRH) but similarly valued. These stocks are Ingersoll-Rand Inc. (NYSE:IR), Sirius XM Holdings Inc (NASDAQ:SIRI), PPG Industries, Inc. (NYSE:PPG), and LyondellBasell Industries NV (NYSE:LYB). This group of stocks’ market values match CRH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IR | 47 | 1411941 | 2 |

| SIRI | 31 | 1431150 | -5 |

| PPG | 35 | 465224 | 5 |

| LYB | 40 | 377389 | 6 |

| Average | 38.25 | 921426 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.25 hedge funds with bullish positions and the average amount invested in these stocks was $921 million. That figure was $184 million in CRH’s case. Ingersoll-Rand Inc. (NYSE:IR) is the most popular stock in this table. On the other hand Sirius XM Holdings Inc (NASDAQ:SIRI) is the least popular one with only 31 bullish hedge fund positions. Compared to these stocks CRH PLC (NYSE:CRH) is even less popular than SIRI. Hedge funds dodged a bullet by taking a bearish stance towards CRH. Our calculations showed that the top 20 most popular hedge fund stocks returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 11.7% in 2020 through March 11th but managed to beat the market by 3.1 percentage points. Unfortunately CRH wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CRH investors were disappointed as the stock returned -26.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in Q1.

Disclosure: None. This article was originally published at Insider Monkey.