Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

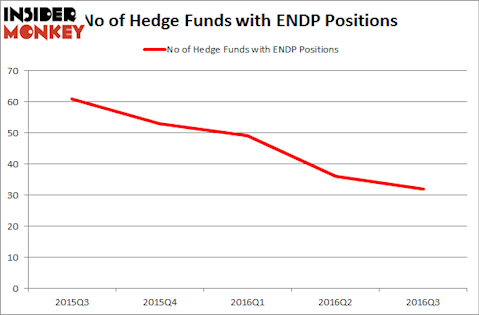

Is Endo International plc – Ordinary Shares (NASDAQ:ENDP) the right pick for your portfolio? Prominent investors are turning less bullish. The number of long hedge fund positions retreated by 4 recently. ENDP was in 32 hedge funds’ portfolios at the end of September. There were 36 hedge funds in our database with ENDP positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as First Niagara Financial Group Inc. (NASDAQ:FNFG), American Capital Ltd. (NASDAQ:ACAS), and Regal Entertainment Group (NYSE:RGC) to gather more data points.

Follow Endo Health Solutions Inc. (NASDAQ:ENDP)

Follow Endo Health Solutions Inc. (NASDAQ:ENDP)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

What have hedge funds been doing with Endo International plc – Ordinary Shares (NASDAQ:ENDP)?

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a decline of 11% from one quarter earlier, and the fourth-straight quarter with declining hedge fund ownership of the stock. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John Paulson’s Paulson & Co has the most valuable position in Endo International plc – Ordinary Shares (NASDAQ:ENDP), worth close to $160.3 million, corresponding to 1.7% of its total 13F portfolio. The second most bullish fund manager is Larry Robbins of Glenview Capital, with an $85.7 million position. Remaining peers with similar optimism comprise Stephen DuBois’ Camber Capital Management, Malcolm Fairbairn’s Ascend Capital, and Zach Schreiber’s Point State Capital.

Judging by the fact that Endo International plc – Ordinary Shares (NASDAQ:ENDP) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there is a sect of money managers who sold off their positions entirely by the end of the third quarter. It’s worth mentioning that Curtis Macnguyen’s Ivory Capital (Investment Mgmt) dumped the biggest investment of the “upper crust” of funds watched by Insider Monkey, worth close to $32.6 million in call options, and Daniel S. Och’s OZ Management was right behind this move, as the fund dumped about $29.8 million worth of options. These transactions are interesting, as aggregate hedge fund interest dropped by 4 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Endo International plc – Ordinary Shares (NASDAQ:ENDP) but similarly valued. These stocks are First Niagara Financial Group Inc. (NASDAQ:FNFG), American Capital Ltd. (NASDAQ:ACAS), Regal Entertainment Group (NYSE:RGC), and Sprouts Farmers Market Inc (NASDAQ:SFM). This group of stocks’ market caps are closest to ENDP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNFG | 1 | 4 | -23 |

| ACAS | 28 | 600404 | -6 |

| RGC | 19 | 158022 | 1 |

| SFM | 22 | 139941 | 0 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $225 million. That figure was $797 million in ENDP’s case. American Capital Ltd. (NASDAQ:ACAS) is the most popular stock in this table. On the other hand First Niagara Financial Group Inc. (NASDAQ:FNFG) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Endo International plc – Ordinary Shares (NASDAQ:ENDP) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio, though sentiment is falling fast.

Disclosure: None