Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what elite funds and billionaire investors think before doing extensive research on a stock. In this article, we take a closer look at Mylan NV (NASDAQ:MYL) from the perspective of those elite funds.

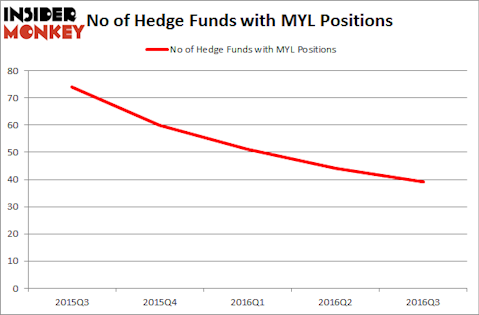

Mylan NV (NASDAQ:MYL) investors should pay attention to an 11% decrease in hedge fund ownership lately. At the end of this article we will also compare MYL to other stocks including Aviva Plc (ADR) (NYSE:AV), HP Inc. (NYSE:HPQ), and Paychex, Inc. (NASDAQ:PAYX) to get a better sense of its popularity.

Follow Mylan Inc. (Old Filings) (NASDAQ:MYL)

Follow Mylan Inc. (Old Filings) (NASDAQ:MYL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bogdanhoda/Shutterstock.com

With all of this in mind, we’re going to analyze the fresh action encompassing Mylan NV (NASDAQ:MYL).

How have hedgies been trading Mylan NV (NASDAQ:MYL)?

At the end of the third quarter, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, an 11% drop from the previous quarter, and the fourth-straight quarter that hedge fund ownership of Mylan has declined. From having over 70 hedge fund shareholders at one point, there are now just 39 long Mylan among those we track. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, John Paulson’s Paulson & Co has the biggest position in Mylan NV (NASDAQ:MYL), worth close to $831.5 million, accounting for 9% of its total 13F portfolio. The second most bullish fund manager is Greenlight Capital, led by David Einhorn, holding a $244 million position; 4.7% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors with similar optimism contain Stephen DuBois’ Camber Capital Management, Conan Laughlin’s North Tide Capital and James E. Flynn’s Deerfield Management.

Seeing as Mylan NV (NASDAQ:MYL) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of funds that elected to cut their full holdings in the third quarter. It’s worth mentioning that Carl Tiedemann and Michael Tiedemann’s TIG Advisors sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, worth about $19.8 million in stock, and Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management was right behind this move, as the fund dropped about $17.6 million worth of shares. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 5 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Mylan NV (NASDAQ:MYL) but similarly valued. We will take a look at Aviva Plc (ADR) (NYSE:AV), HP Inc. (NYSE:HPQ), Paychex, Inc. (NASDAQ:PAYX), and State Street Corporation (NYSE:STT). This group of stocks’ market caps resemble MYL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AV | 5 | 2883 | 1 |

| HPQ | 39 | 1293117 | -1 |

| PAYX | 24 | 612841 | 1 |

| STT | 31 | 633743 | -2 |

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $636 million. That figure was $1.82 billion in MYL’s case. HP Inc. (NYSE:HPQ) is the most popular stock in this table. On the other hand Aviva Plc (ADR) (NYSE:AV) is the least popular one with only 5 bullish hedge fund positions. Mylan NV (NASDAQ:MYL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on, not running for their lives from. In this regard HPQ might be a better candidate to consider for a long position.

Disclosure: None