Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. The NASDAQ and Russell 2000 indices are already in correction territory. More importantly, the Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in October. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards SVB Financial Group (NASDAQ:SIVB).

Hedge funds were pretty excited about SVB Financial based on their second quarter trading activity. Hedge fund ownership of the stock jumped by 32%, lead by new positions being initiated by the likes of Steve Cohen’s Point72 Asset Management (63,100 shares) and James Crichton’s Hitchwood Capital Management (90,000 shares). Billionaire money managers were just as bullish, as the stock landed in the top 10 on our countdown of the 25 Stocks Billionaires Are Piling On. SVB Financial shares have slumped by over 20% since the beginning of October, being dragged down by slowing deposit growth and a premium valuation compared to peers.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action regarding SVB Financial Group (NASDAQ:SIVB).

Hedge fund activity in SVB Financial Group (NASDAQ:SIVB)

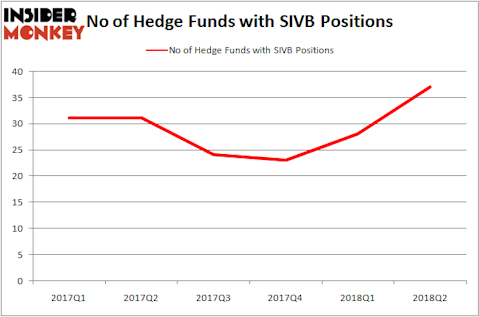

Heading into the fourth quarter of 2018, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a 32% jump from the second quarter of 2018. The graph below displays the number of hedge funds with bullish positions in SIVB over the last 6 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Ken Fisher’s Fisher Asset Management held the most valuable stake in SVB Financial Group (NASDAQ:SIVB), which was worth $332.4 million at the end of the second quarter. On the second spot was Millennium Management which had amassed $222.6 million worth of shares. Moreover, Spindletop Capital, BlueMar Capital Management, and Columbus Circle Investors were also bullish on SVB Financial Group (NASDAQ:SIVB), allocating a large percentage of their 13F portfolios to this stock.

With general bullishness amongst the heavyweights, key hedge funds have jumped into SVB Financial Group (NASDAQ:SIVB) headfirst. Shellback Capital, managed by Doug Gordon, Jon Hilsabeck and Don Jabro, created the most outsized position in SVB Financial Group (NASDAQ:SIVB) during Q2, valued at $23.7 million at the end of the second quarter. James Crichton’s Hitchwood Capital Management also initiated a $26 million position during the quarter. The other funds with brand new SIVB positions included Robert Pohly’s Samlyn Capital, Steve Cohen’s Point72 Asset Management, and Jim Simons’ Renaissance Technologies.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as SVB Financial Group (NASDAQ:SIVB) but similarly valued. These stocks are Realty Income Corp (NYSE:O), NASDAQ OMX Group, Inc. (NASDAQ:NDAQ), McCormick & Company, Incorporated (NYSE:MKC), and Evergy, Inc. (NYSE:EVRG). This group of stocks’ market valuations match SIVB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| O | 15 | 138100 | -1 |

| NDAQ | 18 | 298919 | -7 |

| MKC | 21 | 202360 | 1 |

| EVRG | 25 | 1751905 | 25 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $598 million. That figure was $1.20 billion in SIVB’s case. Evergy, Inc. (NYSE:EVRG) is the most popular stock in this table. On the other hand Realty Income Corp (NYSE:O) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks SVB Financial Group (NASDAQ:SIVB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers and their bullishness only continues to grow, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.