At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Amarin Corporation plc (NASDAQ:AMRN).

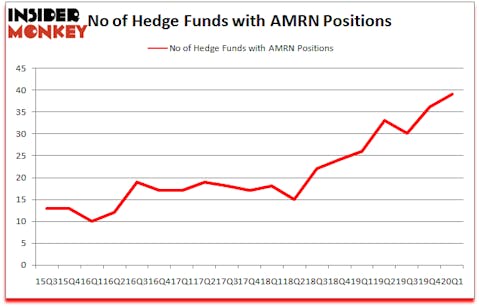

Is Amarin Corporation plc (NASDAQ:AMRN) the right investment to pursue these days? The smart money is taking a bullish view. The number of long hedge fund positions went up by 3 lately. Our calculations also showed that AMRN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). AMRN was in 39 hedge funds’ portfolios at the end of the first quarter of 2020. There were 36 hedge funds in our database with AMRN positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 51 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to review the latest hedge fund action regarding Amarin Corporation plc (NASDAQ:AMRN).

How are hedge funds trading Amarin Corporation plc (NASDAQ:AMRN)?

At the end of the first quarter, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AMRN over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Amarin Corporation plc (NASDAQ:AMRN) was held by Baker Bros. Advisors, which reported holding $138 million worth of stock at the end of September. It was followed by Point72 Asset Management with a $36.9 million position. Other investors bullish on the company included Healthcor Management LP, Rock Springs Capital Management, and Farallon Capital. In terms of the portfolio weights assigned to each position Stonepine Capital allocated the biggest weight to Amarin Corporation plc (NASDAQ:AMRN), around 5.55% of its 13F portfolio. Eversept Partners is also relatively very bullish on the stock, designating 3.55 percent of its 13F equity portfolio to AMRN.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Renaissance Technologies, established the most outsized position in Amarin Corporation plc (NASDAQ:AMRN). Renaissance Technologies had $9.5 million invested in the company at the end of the quarter. Timothy P. Lynch’s Stonepine Capital also made a $5.3 million investment in the stock during the quarter. The other funds with brand new AMRN positions are Henrik Rhenman’s Rhenman & Partners Asset Management, Michael Rockefeller and KarláKroeker’s Woodline Partners, and Bhagwan Jay Rao’s Integral Health Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Amarin Corporation plc (NASDAQ:AMRN). We will take a look at HB Fuller Co (NYSE:FUL), Columbia Property Trust Inc (NYSE:CXP), United Community Banks Inc (NASDAQ:UCBI), and SPX Corporation (NYSE:SPXC). This group of stocks’ market values are closest to AMRN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FUL | 18 | 124227 | 4 |

| CXP | 17 | 50559 | -5 |

| UCBI | 11 | 28692 | -5 |

| SPXC | 14 | 47679 | -5 |

| Average | 15 | 62789 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $328 million in AMRN’s case. HB Fuller Co (NYSE:FUL) is the most popular stock in this table. On the other hand United Community Banks Inc (NASDAQ:UCBI) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Amarin Corporation plc (NASDAQ:AMRN) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 8.3% in 2020 through the end of May but still managed to beat the market by 13.2 percentage points. Hedge funds were also right about betting on AMRN as the stock returned 71.5% so far in Q2 (through the end of May) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Amarin Corp Plc (NASDAQ:AMRN)

Follow Amarin Corp Plc (NASDAQ:AMRN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.