Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Vornado Realty Trust (NYSE:VNO), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

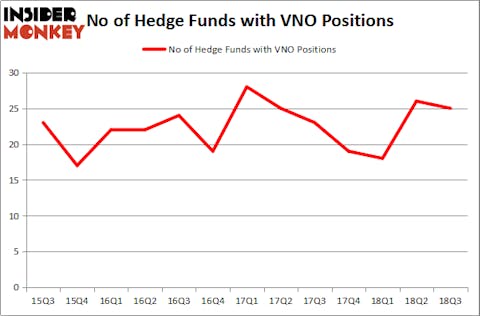

Is Vornado Realty Trust (NYSE:VNO) a buy here? Hedge funds are taking a bearish view. The number of long hedge fund positions dropped by 1 in recent months. Our calculations also showed that VNO isn’t among the 30 most popular stocks among hedge funds. VNO was in 25 hedge funds’ portfolios at the end of the third quarter of 2018. There were 26 hedge funds in our database with VNO holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are dozens of tools shareholders have at their disposal to size up their holdings. A couple of the best tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top investment managers can trounce the market by a solid margin (see the details here).

Let’s analyze the new hedge fund action surrounding Vornado Realty Trust (NYSE:VNO).

What does the smart money think about Vornado Realty Trust (NYSE:VNO)?

Heading into the fourth quarter of 2018, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in VNO heading into this year. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Among these funds, Long Pond Capital held the most valuable stake in Vornado Realty Trust (NYSE:VNO), which was worth $211.6 million at the end of the third quarter. On the second spot was Third Avenue Management which amassed $61 million worth of shares. Moreover, Citadel Investment Group, AEW Capital Management, and Castle Hook Partners were also bullish on Vornado Realty Trust (NYSE:VNO), allocating a large percentage of their portfolios to this stock.

Since Vornado Realty Trust (NYSE:VNO) has experienced falling interest from the aggregate hedge fund industry, logic holds that there were a few funds who were dropping their full holdings in the third quarter. Intriguingly, Jeffrey Pierce’s Snow Park Capital Partners sold off the biggest position of the 700 funds tracked by Insider Monkey, comprising close to $14.8 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also said goodbye to its stock, about $11.9 million worth. These moves are important to note, as aggregate hedge fund interest fell by 1 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Vornado Realty Trust (NYSE:VNO) but similarly valued. We will take a look at CMS Energy Corporation (NYSE:CMS), Darden Restaurants, Inc. (NYSE:DRI), Wynn Resorts, Limited (NASDAQ:WYNN), and Fortis Inc. (NYSE:FTS). This group of stocks’ market caps are similar to VNO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMS | 22 | 282246 | 4 |

| DRI | 22 | 980978 | -3 |

| WYNN | 43 | 2481578 | -1 |

| FTS | 14 | 230527 | 0 |

| Average | 25.25 | 993832 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.25 hedge funds with bullish positions and the average amount invested in these stocks was $994 million. That figure was $481 million in VNO’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Fortis Inc. (NYSE:FTS) is the least popular one with only 14 bullish hedge fund positions. Vornado Realty Trust (NYSE:VNO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WYNN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.