Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Potbelly Corp (NASDAQ:PBPB) to find out whether it was one of their high conviction long-term ideas.

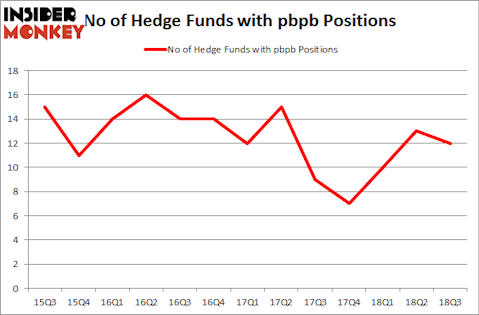

Potbelly Corp (NASDAQ:PBPB) investors should be aware of a decrease in enthusiasm from smart money in recent months. PBPB was in 12 hedge funds’ portfolios at the end of September. There were 13 hedge funds in our database with PBPB holdings at the end of the previous quarter. Our calculations also showed that pbpb isn’t among the 30 most popular stocks among hedge funds.

Today there are several formulas shareholders have at their disposal to evaluate their stock investments. A pair of the most under-the-radar formulas are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can outperform the broader indices by a significant margin (see the details here).

We’re going to take a look at the new hedge fund action encompassing Potbelly Corp (NASDAQ:PBPB).

How have hedgies been trading Potbelly Corp (NASDAQ:PBPB)?

Heading into the fourth quarter of 2018, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in PBPB heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Potbelly Corp (NASDAQ:PBPB), which was worth $26.6 million at the end of the third quarter. On the second spot was Ancora Advisors which amassed $14.3 million worth of shares. Moreover, Arrowstreet Capital, Millennium Management, and GLG Partners were also bullish on Potbelly Corp (NASDAQ:PBPB), allocating a large percentage of their portfolios to this stock.

Since Potbelly Corp (NASDAQ:PBPB) has faced bearish sentiment from hedge fund managers, we can see that there is a sect of hedge funds that slashed their positions entirely last quarter. It’s worth mentioning that Anand Parekh’s Alyeska Investment Group dropped the largest stake of all the hedgies tracked by Insider Monkey, totaling an estimated $2 million in stock. Malcolm Fairbairn’s fund, Ascend Capital, also said goodbye to its stock, about $1.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Potbelly Corp (NASDAQ:PBPB) but similarly valued. These stocks are Acer Therapeutics Inc. (NASDAQ:ACER), Dynagas LNG Partners LP (NYSE:DLNG), Seneca Foods Corp (NASDAQ:SENEB), and SilverBow Resorces, Inc. (NYSE:SBOW). This group of stocks’ market valuations are closest to PBPB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACER | 7 | 46398 | 4 |

| DLNG | 3 | 791 | 0 |

| SENEB | 2 | 2181 | 0 |

| SBOW | 11 | 187696 | 4 |

| Average | 5.75 | 59267 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $59 million. That figure was $58 million in PBPB’s case. SilverBow Resorces, Inc. (NYSE:SBOW) is the most popular stock in this table. On the other hand Seneca Foods Corp (NASDAQ:SENEB) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Potbelly Corp (NASDAQ:PBPB) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.