At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

FGL Holdings (NYSE:FG) investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. Our calculations also showed that FG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the key hedge fund action regarding FGL Holdings (NYSE:FG).

How have hedgies been trading FGL Holdings (NYSE:FG)?

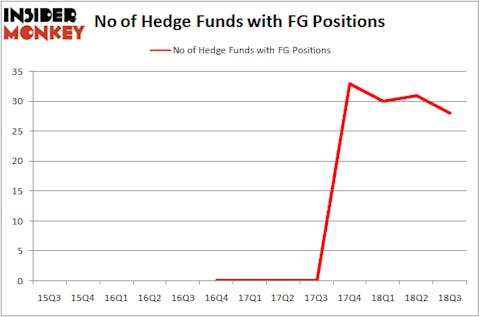

At Q3’s end, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FG over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Kingstown Capital Management was the largest shareholder of FGL Holdings (NYSE:FG), with a stake worth $53.7 million reported as of the end of September. Trailing Kingstown Capital Management was Mason Capital Management, which amassed a stake valued at $53.5 million. Canyon Capital Advisors, Angelo Gordon & Co, and Ulysses Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that FGL Holdings (NYSE:FG) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of funds that elected to cut their entire stakes heading into Q3. Interestingly, Joshua Nash’s Ulysses Management dropped the biggest investment of the 700 funds tracked by Insider Monkey, comprising close to $18.8 million in stock. Jamie Mendola’s fund, Pacific Grove Capital, also dropped its stock, about $10.9 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as FGL Holdings (NYSE:FG) but similarly valued. We will take a look at GCP Applied Technologies Inc. (NYSE:GCP), Insight Enterprises, Inc. (NASDAQ:NSIT), Laredo Petroleum Inc (NYSE:LPI), and Mack Cali Realty Corp (NYSE:CLI). All of these stocks’ market caps are similar to FG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GCP | 19 | 584832 | -1 |

| NSIT | 22 | 140090 | 3 |

| LPI | 20 | 589934 | 4 |

| CLI | 11 | 113715 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $357 million. That figure was $346 million in FG’s case. Insight Enterprises, Inc. (NASDAQ:NSIT) is the most popular stock in this table. On the other hand Mack Cali Realty Corp (NYSE:CLI) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks FGL Holdings (NYSE:FG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.