How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Community Health Systems, Inc. (NYSE:CYH).

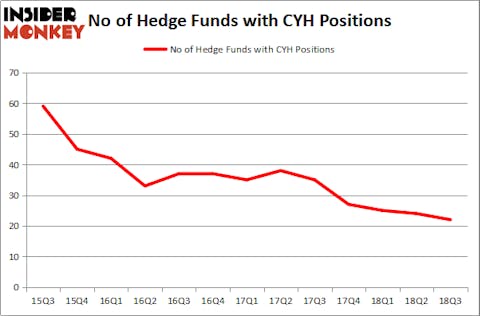

Is Community Health Systems, Inc. (NYSE:CYH) a bargain? The best stock pickers are in a pessimistic mood. The number of bullish hedge fund positions were trimmed by 2 recently. Our calculations also showed that CYH isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are perceived as unimportant, outdated financial vehicles of yesteryear. While there are greater than 8,000 funds with their doors open today, Our researchers choose to focus on the masters of this group, about 700 funds. These money managers preside over bulk of all hedge funds’ total capital, and by watching their first-class investments, Insider Monkey has identified various investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a glance at the fresh hedge fund action regarding Community Health Systems, Inc. (NYSE:CYH).

What does the smart money think about Community Health Systems, Inc. (NYSE:CYH)?

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from the previous quarter. On the other hand, there were a total of 27 hedge funds with a bullish position in CYH at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

More specifically, Saba Capital was the largest shareholder of Community Health Systems, Inc. (NYSE:CYH), with a stake worth $28.5 million reported as of the end of September. Trailing Saba Capital was Elliott Management, which amassed a stake valued at $15.6 million. Royce & Associates, Owl Creek Asset Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Community Health Systems, Inc. (NYSE:CYH) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of hedge funds that decided to sell off their entire stakes heading into Q3. At the top of the heap, Zach Schreiber’s Point State Capital sold off the largest investment of all the hedgies monitored by Insider Monkey, valued at an estimated $8.4 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund dumped about $2.4 million worth. These moves are interesting, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Community Health Systems, Inc. (NYSE:CYH) but similarly valued. We will take a look at Donegal Group Inc (NASDAQ:DGICA), Ares Commercial Real Estate Corp (NYSE:ACRE), Century Bancorp, Inc. (NASDAQ:CNBKA), and One Madison Corporation (NYSE:OMAD). This group of stocks’ market valuations are closest to CYH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DGICA | 5 | 8130 | 0 |

| ACRE | 5 | 9936 | -2 |

| CNBKA | 3 | 11234 | 0 |

| OMAD | 14 | 48556 | 2 |

| Average | 6.75 | 19464 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $57 million in CYH’s case. One Madison Corporation (NYSE:OMAD) is the most popular stock in this table. On the other hand Century Bancorp, Inc. (NASDAQ:CNBKA) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Community Health Systems, Inc. (NYSE:CYH) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.