The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 30th. We at Insider Monkey have made an extensive database of more than 873 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded CNH Industrial NV (NYSE:CNHI) based on those filings.

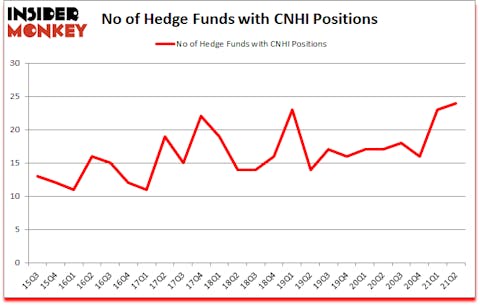

Is CNH Industrial NV (NYSE:CNHI) a good investment now? The smart money was buying. The number of bullish hedge fund bets rose by 1 lately. CNH Industrial NV (NYSE:CNHI) was in 24 hedge funds’ portfolios at the end of June. The all time high for this statistic was previously 23. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that CNHI isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 23 hedge funds in our database with CNHI positions at the end of the first quarter.

In today’s marketplace there are numerous tools market participants employ to size up stocks. Some of the most innovative tools are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outclass their index-focused peers by a healthy amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a peek at the new hedge fund action regarding CNH Industrial NV (NYSE:CNHI).

Do Hedge Funds Think CNHI Is A Good Stock To Buy Now?

At the end of June, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the first quarter of 2020. On the other hand, there were a total of 17 hedge funds with a bullish position in CNHI a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the biggest position in CNH Industrial NV (NYSE:CNHI). Arrowstreet Capital has a $171.5 million position in the stock, comprising 0.2% of its 13F portfolio. On Arrowstreet Capital’s heels is GAMCO Investors, led by Mario Gabelli, holding a $166.6 million position; 1.4% of its 13F portfolio is allocated to the company. Some other peers that hold long positions contain Dmitry Balyasny’s Balyasny Asset Management, Mason Hawkins’s Southeastern Asset Management and Renaissance Technologies. In terms of the portfolio weights assigned to each position Odey Asset Management Group allocated the biggest weight to CNH Industrial NV (NYSE:CNHI), around 7.65% of its 13F portfolio. Tiger Eye Capital is also relatively very bullish on the stock, earmarking 4.58 percent of its 13F equity portfolio to CNHI.

Now, specific money managers have been driving this bullishness. Shellback Capital, managed by Doug Gordon, Jon Hilsabeck and Don Jabro, initiated the most outsized position in CNH Industrial NV (NYSE:CNHI). Shellback Capital had $10.7 million invested in the company at the end of the quarter. Ryan Caldwell’s Chiron Investment Management also made a $0.9 million investment in the stock during the quarter. The other funds with brand new CNHI positions are Gavin Saitowitz and Cisco J. del Valle’s Prelude Capital (previously Springbok Capital), Donald Sussman’s Paloma Partners, and Lee Ainslie’s Maverick Capital.

Let’s check out hedge fund activity in other stocks similar to CNH Industrial NV (NYSE:CNHI). We will take a look at Trip.com Group Limited (NASDAQ:TCOM), MongoDB, Inc. (NASDAQ:MDB), CGI Inc. (NYSE:GIB), The Clorox Company (NYSE:CLX), Imperial Oil Limited (NYSE:IMO), Teradyne, Inc. (NASDAQ:TER), and The Hartford Financial Services Group Inc (NYSE:HIG). This group of stocks’ market values match CNHI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCOM | 41 | 1997956 | 6 |

| MDB | 44 | 1693975 | -2 |

| GIB | 14 | 252456 | -1 |

| CLX | 37 | 980009 | -1 |

| IMO | 15 | 74828 | 2 |

| TER | 44 | 1687443 | 0 |

| HIG | 43 | 1468819 | -14 |

| Average | 34 | 1165069 | -1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1165 million. That figure was $681 million in CNHI’s case. MongoDB, Inc. (NASDAQ:MDB) is the most popular stock in this table. On the other hand CGI Inc. (NYSE:GIB) is the least popular one with only 14 bullish hedge fund positions. CNH Industrial NV (NYSE:CNHI) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for CNHI is 52.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on CNHI as the stock returned 4.3% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Cnh Industrial N.v. (NYSE:CNH)

Follow Cnh Industrial N.v. (NYSE:CNH)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Agriculture Technology Stocks To Buy Now

- Value Investor Bill Miller’s Top 10 Stock Picks

- 10 Best 3D Printing and Additive Manufacturing Stocks to Buy

Disclosure: None. This article was originally published at Insider Monkey.