Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the second quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of DXC Technology Company (NYSE:DXC) based on that data.

Among hedge funds’ favorite stocks, DXC is an unexpected name, yet it was owned by 56 hedge funds on June 30, ranking it as one of the top 60 most popular stocks (check here for the 25 Most Popular Stocks Among Hedge Funds in 2018). DXC also unexpectedly topped our list of 25 Stocks Billionaires Are Piling On, being owned by hedge fund titans like Larry Robbins’ Glenview Capital (5.28 million shares), Barry Rosenstein’s JANA Partners (638,899 shares) and Steve Cohen’s Point72 Asset Management (1.69 million shares). DXC has been blistered by executive departures and layoffs that have left the company shorthanded and its results sagging. The turmoil climaxed near the end of October when a leaked memo trumpeted the unexpected October 31 departure of struggling DXC Americas’ leader Karan Puri after less than a year in the position. The division’s sales have allegedly suffered double-digit declines.

To most shareholders, hedge funds are seen as unimportant, outdated financial tools of the past. While there are greater than 8,000 funds in operation at the moment, our experts look at the upper echelon of this club, approximately 700 funds. These investment experts have their hands on the majority of the smart money’s total asset base, and by following their inimitable stock picks, Insider Monkey has figured out a number of investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s small-cap hedge fund strategy outrun the S&P 500 index by 12 percentage points annually for a decade in their back tests.

We’re going to take a peek at the latest hedge fund action surrounding DXC Technology Company (NYSE:DXC).

Hedge fund activity in DXC Technology Company (NYSE:DXC)

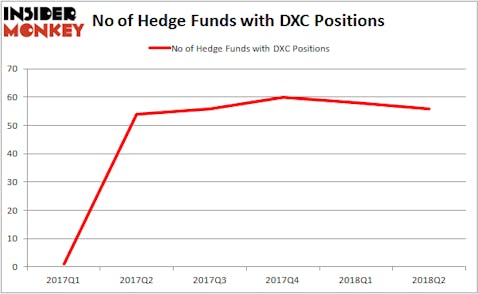

Heading into the fourth quarter of 2018, a total of 56 of the hedge funds tracked by Insider Monkey held long positions in this stock, a dip of 3% from the previous quarter. The graph below displays the number of hedge funds with bullish positions in DXC over the last 6 quarters, which has remained relatively stable over the past year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Larry Robbins’ Glenview Capital held the most valuable stake in DXC Technology Company (NYSE:DXC), which was worth $425.8 million at the end of the second quarter. On the second spot was AQR Capital Management which had amassed $267.3 million worth of shares. Moreover, Marcato Capital Management, Hunt Lane Capital, and Kingstown Capital Management were also bullish on DXC Technology Company (NYSE:DXC), allocating a large percentage of their portfolios to this stock.

Seeing as DXC Technology Company (NYSE:DXC) experienced falling interest from the smart money during Q2, logic holds that there lies a certain “tier” of hedgies that decided to sell off their entire stakes heading into Q3. Intriguingly, David Gallo’s Valinor Management LLC said goodbye to the largest investment of all the hedgies tracked by Insider Monkey, comprising close to $52.3 million in stock. Christopher Lord’s fund, Criterion Capital, also sold off its stock, about $20.4 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to DXC Technology Company (NYSE:DXC). These stocks are Corning Incorporated (NYSE:GLW), Zimmer Biomet Holdings Inc (NYSE:ZBH), The Kroger Co. (NYSE:KR), and Williams Companies, Inc. (NYSE:WMB). All of these stocks’ market caps are closest to DXC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLW | 21 | 268630 | -4 |

| ZBH | 35 | 1206646 | -1 |

| KR | 29 | 534717 | 6 |

| WMB | 40 | 1715234 | 0 |

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $931 million. That figure was $2.60 billion in DXC’s case. Williams Companies, Inc. (NYSE:WMB) is the most popular stock in this table. On the other hand Corning Incorporated (NYSE:GLW) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks DXC Technology Company (NYSE:DXC) is more popular among hedge funds and a huge favorite among billionaires. While the operational miscues taking place at the company are very much cause for concern, a daring contrarian investor could look to buy low on shares after their 34% declines since September 17.

Disclosure: None. This article was originally published at Insider Monkey.