The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 873 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 30th, 2021. What do these smart investors think about Healthcare Realty Trust Inc (NYSE:HR)?

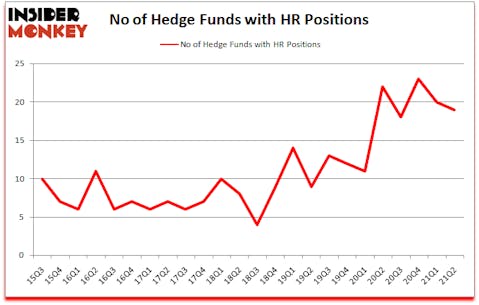

Healthcare Realty Trust Inc (NYSE:HR) shareholders have witnessed a decrease in hedge fund sentiment in recent months. Healthcare Realty Trust Inc (NYSE:HR) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 23. Our calculations also showed that HR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Gavin Saitowitz of Prelude Capital

Keeping this in mind we’re going to view the new hedge fund action surrounding Healthcare Realty Trust Inc (NYSE:HR).

Do Hedge Funds Think HR Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HR over the last 24 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Healthcare Realty Trust Inc (NYSE:HR) was held by GLG Partners, which reported holding $46.9 million worth of stock at the end of June. It was followed by Millennium Management with a $27.8 million position. Other investors bullish on the company included AQR Capital Management, Balyasny Asset Management, and Echo Street Capital Management. In terms of the portfolio weights assigned to each position Hill Winds Capital allocated the biggest weight to Healthcare Realty Trust Inc (NYSE:HR), around 2.16% of its 13F portfolio. Gillson Capital is also relatively very bullish on the stock, earmarking 0.75 percent of its 13F equity portfolio to HR.

Because Healthcare Realty Trust Inc (NYSE:HR) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there exists a select few hedge funds who sold off their positions entirely in the second quarter. Intriguingly, Eduardo Abush’s Waterfront Capital Partners dumped the biggest position of all the hedgies tracked by Insider Monkey, totaling about $7.1 million in stock. Parvinder Thiara’s fund, Athanor Capital, also dumped its stock, about $1.5 million worth. These moves are interesting, as aggregate hedge fund interest fell by 1 funds in the second quarter.

Let’s also examine hedge fund activity in other stocks similar to Healthcare Realty Trust Inc (NYSE:HR). We will take a look at New Relic Inc (NYSE:NEWR), frontdoor, inc. (NASDAQ:FTDR), Lions Gate Entertainment Corporation (NYSE:LGF-B), H&R Block, Inc. (NYSE:HRB), Adient plc (NYSE:ADNT), Balchem Corporation (NASDAQ:BCPC), and JFrog Ltd. (NASDAQ:FROG). All of these stocks’ market caps are similar to HR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEWR | 29 | 1281799 | 2 |

| FTDR | 33 | 686925 | -3 |

| LGF-B | 22 | 518626 | -5 |

| HRB | 30 | 229563 | 3 |

| ADNT | 35 | 662444 | -4 |

| BCPC | 15 | 50095 | 1 |

| FROG | 12 | 251080 | -8 |

| Average | 25.1 | 525790 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.1 hedge funds with bullish positions and the average amount invested in these stocks was $526 million. That figure was $187 million in HR’s case. Adient plc (NYSE:ADNT) is the most popular stock in this table. On the other hand JFrog Ltd. (NASDAQ:FROG) is the least popular one with only 12 bullish hedge fund positions. Healthcare Realty Trust Inc (NYSE:HR) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for HR is 44. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on HR as the stock returned 9.7% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Hrti Llc (NYSE:HR)

Follow Hrti Llc (NYSE:HR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Companies That Aren’t Profitable

- Billionaire Lee Ainslie’s Top 10 Stock Picks

- Top 25 Free Games Without Wifi or Internet

Disclosure: None. This article was originally published at Insider Monkey.