Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Badger Meter, Inc. (NYSE:BMI).

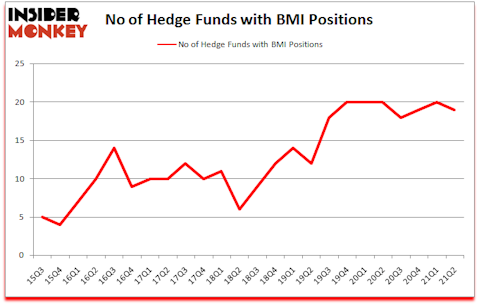

Is Badger Meter, Inc. (NYSE:BMI) going to take off soon? Prominent investors were taking a pessimistic view. The number of long hedge fund bets retreated by 1 lately. Badger Meter, Inc. (NYSE:BMI) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 20. Our calculations also showed that BMI isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Richard Chilton of Chilton Investment Company

Keeping this in mind let’s check out the new hedge fund action encompassing Badger Meter, Inc. (NYSE:BMI).

Do Hedge Funds Think BMI Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the first quarter of 2020. On the other hand, there were a total of 20 hedge funds with a bullish position in BMI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ian Simm’s Impax Asset Management has the biggest position in Badger Meter, Inc. (NYSE:BMI), worth close to $110.1 million, comprising 0.5% of its total 13F portfolio. Coming in second is GLG Partners, managed by Noam Gottesman, which holds a $16.5 million position; 0.1% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that hold long positions consist of Charles Montanaro’s Montanaro Asset Management, Mario Gabelli’s GAMCO Investors and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Montanaro Asset Management allocated the biggest weight to Badger Meter, Inc. (NYSE:BMI), around 1.92% of its 13F portfolio. Impax Asset Management is also relatively very bullish on the stock, designating 0.49 percent of its 13F equity portfolio to BMI.

Due to the fact that Badger Meter, Inc. (NYSE:BMI) has witnessed falling interest from hedge fund managers, it’s safe to say that there were a few fund managers that elected to cut their positions entirely heading into Q3. At the top of the heap, Donald Sussman’s Paloma Partners cut the largest investment of all the hedgies watched by Insider Monkey, totaling about $1.1 million in stock, and Parvinder Thiara’s Athanor Capital was right behind this move, as the fund sold off about $1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Badger Meter, Inc. (NYSE:BMI). We will take a look at Youdao, Inc. (NYSE:DAO), Atlantic Union Bankshares Corporation (NASDAQ:AUB), Comfort Systems USA, Inc. (NYSE:FIX), Abercrombie & Fitch Co. (NYSE:ANF), Mr. Cooper Group Inc. (NASDAQ:COOP), Laureate Education, Inc. (NASDAQ:LAUR), and Nu Skin Enterprises, Inc. (NYSE:NUS). This group of stocks’ market values are similar to BMI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DAO | 5 | 331884 | -4 |

| AUB | 12 | 45592 | 1 |

| FIX | 24 | 80650 | 5 |

| ANF | 32 | 564862 | 12 |

| COOP | 28 | 660134 | 4 |

| LAUR | 20 | 203841 | -1 |

| NUS | 20 | 298814 | 1 |

| Average | 20.1 | 312254 | 2.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.1 hedge funds with bullish positions and the average amount invested in these stocks was $312 million. That figure was $187 million in BMI’s case. Abercrombie & Fitch Co. (NYSE:ANF) is the most popular stock in this table. On the other hand Youdao, Inc. (NYSE:DAO) is the least popular one with only 5 bullish hedge fund positions. Badger Meter, Inc. (NYSE:BMI) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for BMI is 58.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on BMI as the stock returned 6.7% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Badger Meter Inc (NYSE:BMI)

Follow Badger Meter Inc (NYSE:BMI)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Health Systems in the US

- 10 Best EV SPACs to Buy Now

- 15 Largest EPC Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.