Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

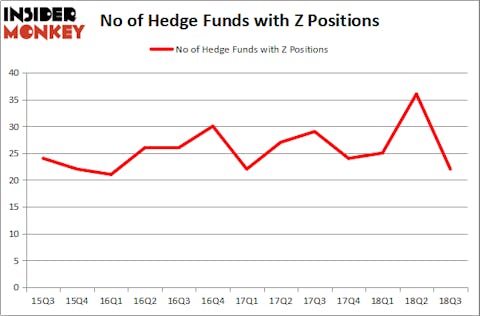

Zillow Group Inc (NASDAQ:Z) has seen a bi decrease in activity from the world’s largest hedge funds lately, ranking as one of 10 Stocks Hedge Funds Ditched in Q3 Just Before the Market Crushed Them. Unsurprisingly, it also failed to rank among the 30 Most Popular Stocks Among Hedge Funds. Z was in 22 hedge funds’ portfolios at the end of September, down from 36 in the middle of 2018.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

What have hedge funds been doing with Zillow Group Inc (NASDAQ:Z)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a 39% stumble from the second quarter of 2018. By comparison, 24 hedge funds held shares or bullish call options in Z heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John H. Scully’s SPO Advisory Corp has the largest position in Zillow Group Inc (NASDAQ:Z), worth close to $297.5 million, amounting to 7.3% of its total 13F portfolio. On SPO Advisory Corp’s heels is Karthik Sarma of SRS Investment Management, with a $124.6 million position; 2.6% of its 13F portfolio is allocated to the company. Some other peers that hold long positions contain Christopher R. Hansen’s Valiant Capital and David Goel and Paul Ferri’s Matrix Capital Management.

Since Zillow Group Inc (NASDAQ:Z) has experienced a decline in interest from the smart money, it’s safe to say that there is a sect of hedge funds who were dropping their positions entirely by the end of the third quarter. At the top of the heap, Paul Reeder and Edward Shapiro’s PAR Capital Management dumped the biggest stake of the 700 funds followed by Insider Monkey, valued at about $229.3 million in stock, and Paul Reeder and Edward Shapiro’s PAR Capital Management was right behind this move, as the fund sold off about $101.2 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 14 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Zillow Group Inc (NASDAQ:Z) but similarly valued. These stocks are BorgWarner Inc. (NYSE:BWA), iShares MSCI ACWI ETF (NASDAQ:ACWI), AGNC Investment Corp. (NASDAQ:AGNC), and Goldcorp Inc. (NYSE:GG). This group of stocks’ market valuations are similar to Z’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BWA | 22 | 724710 | -2 |

| ACWI | 8 | 119261 | 0 |

| AGNC | 15 | 216291 | 4 |

| GG | 18 | 94622 | -3 |

| Average | 15.75 | 289 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $289 million. That figure was $755 million in Z’s case. BorgWarner Inc. (NYSE:BWA) is the most popular stock in this table. On the other hand iShares MSCI ACWI Index Fund (NASDAQ:ACWI) is the least popular one with only 8 bullish hedge fund positions. Zillow Group Inc (NASDAQ:Z) is still tied for the most popular stock in this group, but we would like to see hedge fund ownership stabilize before we consider looking into it further.

Disclosure: None. This article was originally published at Insider Monkey.