As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Southwest Gas Holdings, Inc. (NYSE:SWX).

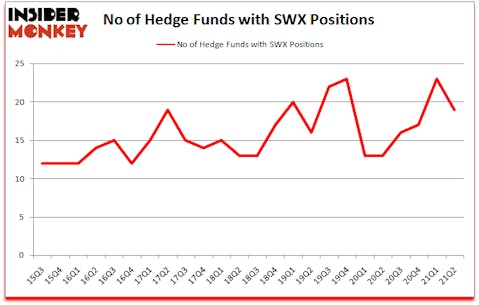

Southwest Gas Holdings, Inc. (NYSE:SWX) investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. Southwest Gas Holdings, Inc. (NYSE:SWX) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 23. Our calculations also showed that SWX isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Mario Gabelli of GAMCO Investors

Now we’re going to take a glance at the fresh hedge fund action encompassing Southwest Gas Holdings, Inc. (NYSE:SWX).

Do Hedge Funds Think SWX Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from the previous quarter. On the other hand, there were a total of 13 hedge funds with a bullish position in SWX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, GAMCO Investors, managed by Mario Gabelli, holds the number one position in Southwest Gas Holdings, Inc. (NYSE:SWX). GAMCO Investors has a $44.3 million position in the stock, comprising 0.4% of its 13F portfolio. The second most bullish fund manager is Israel Englander of Millennium Management, with a $35.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish include Cliff Asness’s AQR Capital Management, Renaissance Technologies and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Coann Capital allocated the biggest weight to Southwest Gas Holdings, Inc. (NYSE:SWX), around 2.92% of its 13F portfolio. Autonomy Capital is also relatively very bullish on the stock, dishing out 0.39 percent of its 13F equity portfolio to SWX.

Because Southwest Gas Holdings, Inc. (NYSE:SWX) has witnessed bearish sentiment from the smart money, logic holds that there is a sect of hedge funds that slashed their positions entirely heading into Q3. At the top of the heap, Frank Fu’s CaaS Capital cut the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling an estimated $24.4 million in stock, and Jinghua Yan’s TwinBeech Capital was right behind this move, as the fund sold off about $0.4 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 4 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Southwest Gas Holdings, Inc. (NYSE:SWX) but similarly valued. We will take a look at Southwestern Energy Company (NYSE:SWN), Turning Point Therapeutics, Inc. (NASDAQ:TPTX), Dillard’s, Inc. (NYSE:DDS), The Brink’s Company (NYSE:BCO), Papa John’s International, Inc. (NASDAQ:PZZA), New Jersey Resources Corp (NYSE:NJR), and Academy Sports and Outdoors, Inc. (NASDAQ:ASO). This group of stocks’ market caps resemble SWX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWN | 27 | 257726 | 5 |

| TPTX | 28 | 646677 | -5 |

| DDS | 18 | 91497 | 5 |

| BCO | 17 | 346879 | -7 |

| PZZA | 30 | 739296 | -2 |

| NJR | 12 | 19131 | 0 |

| ASO | 45 | 709246 | 8 |

| Average | 25.3 | 401493 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.3 hedge funds with bullish positions and the average amount invested in these stocks was $401 million. That figure was $145 million in SWX’s case. Academy Sports and Outdoors, Inc. (NASDAQ:ASO) is the most popular stock in this table. On the other hand New Jersey Resources Corp (NYSE:NJR) is the least popular one with only 12 bullish hedge fund positions. Southwest Gas Holdings, Inc. (NYSE:SWX) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SWX is 36.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on SWX as the stock returned 5.4% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Southwest Gas Holdings Inc. (NYSE:SWX)

Follow Southwest Gas Holdings Inc. (NYSE:SWX)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Animal Feed Companies

- 15 Companies That Benefitted The Most From The Pandemic

- 10 Best Communication Equipment Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.