In this article we will take a look at whether hedge funds think PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

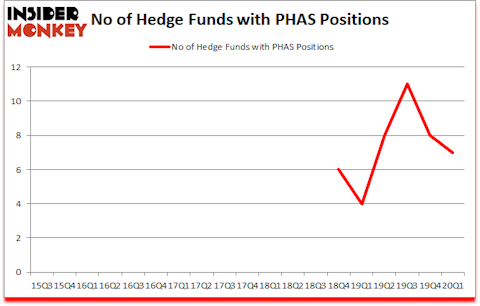

PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS) has seen a decrease in hedge fund interest recently. Our calculations also showed that PHAS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a lot of indicators stock market investors have at their disposal to analyze their stock investments. Some of the most innovative indicators are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the elite investment managers can beat the S&P 500 by a healthy amount (see the details here).

Nathan Fischel of DAFNA Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s analyze the fresh hedge fund action encompassing PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS).

What have hedge funds been doing with PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS)?

At Q1’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. On the other hand, there were a total of 4 hedge funds with a bullish position in PHAS a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management has the largest position in PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS), worth close to $3.7 million, accounting for 0.2% of its total 13F portfolio. On Rock Springs Capital Management’s heels is Ghost Tree Capital, led by Ken Greenberg and David Kim, holding a $1.6 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism include Nathan Fischel’s DAFNA Capital Management, Renaissance Technologies and Hal Mintz’s Sabby Capital. In terms of the portfolio weights assigned to each position DAFNA Capital Management allocated the biggest weight to PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS), around 0.44% of its 13F portfolio. Ghost Tree Capital is also relatively very bullish on the stock, dishing out 0.44 percent of its 13F equity portfolio to PHAS.

Judging by the fact that PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS) has witnessed falling interest from hedge fund managers, it’s easy to see that there is a sect of fund managers who sold off their full holdings by the end of the first quarter. Interestingly, Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management dropped the largest position of the 750 funds monitored by Insider Monkey, totaling about $1.1 million in stock, and Greg Martinez’s Parkman Healthcare Partners was right behind this move, as the fund cut about $0.6 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 1 funds by the end of the first quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS) but similarly valued. These stocks are Malvern Bancorp, Inc. (NASDAQ:MLVF), California BanCorp (NASDAQ:CALB), Scully Royalty Ltd. (NYSE:SRL), and First Savings Financial Group, Inc. (NASDAQ:FSFG). This group of stocks’ market caps match PHAS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MLVF | 5 | 19112 | 1 |

| CALB | 4 | 9702 | 4 |

| SRL | 2 | 6171 | 0 |

| FSFG | 4 | 4528 | -2 |

| Average | 3.75 | 9878 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $8 million in PHAS’s case. Malvern Bancorp, Inc. (NASDAQ:MLVF) is the most popular stock in this table. On the other hand Scully Royalty Ltd. (NYSE:SRL) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks PhaseBio Pharmaceuticals, Inc. (NASDAQ:PHAS) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 13.9% in 2020 through June 10th but still managed to beat the market by 14.2 percentage points. Hedge funds were also right about betting on PHAS as the stock returned 60.1% so far in Q2 (through June 10th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Phasebio Pharmaceuticals Inc (NASDAQ:PHAS)

Follow Phasebio Pharmaceuticals Inc (NASDAQ:PHAS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.