We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article we look at what those investors think of Agios Pharmaceuticals Inc (NASDAQ:AGIO).

Is Agios Pharmaceuticals Inc (NASDAQ:AGIO) a bargain? Hedge funds are getting less optimistic. The number of long hedge fund bets retreated by 1 recently. Our calculations also showed that AGIO isn’t among the 30 most popular stocks among hedge funds. AGIO was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. There were 23 hedge funds in our database with AGIO positions at the end of the previous quarter.

To the average investor there are numerous formulas market participants use to analyze publicly traded companies. A couple of the most underrated formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a healthy amount (see the details here).

We’re going to view the latest hedge fund action surrounding Agios Pharmaceuticals Inc (NASDAQ:AGIO).

How are hedge funds trading Agios Pharmaceuticals Inc (NASDAQ:AGIO)?

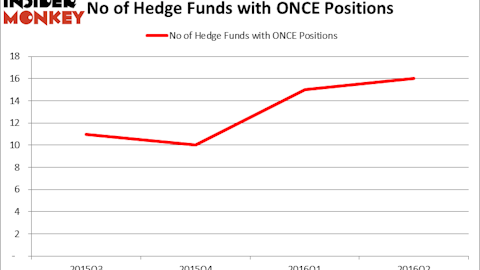

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in AGIO over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Woodford Investment Management, managed by Neil Woodford, holds the most valuable position in Agios Pharmaceuticals Inc (NASDAQ:AGIO). Woodford Investment Management has a $101.6 million position in the stock, comprising 8.1% of its 13F portfolio. The second most bullish fund manager is Alkeon Capital Management, managed by Panayotis Takis Sparaggis, which holds a $53.5 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism consist of Brian Ashford-Russell and Tim Woolley’s Polar Capital, Eli Casdin’s Casdin Capital and Dmitry Balyasny’s Balyasny Asset Management.

Due to the fact that Agios Pharmaceuticals Inc (NASDAQ:AGIO) has experienced declining sentiment from hedge fund managers, it’s easy to see that there was a specific group of hedgies who sold off their positions entirely in the third quarter. At the top of the heap, Christopher James’s Partner Fund Management said goodbye to the largest stake of the 700 funds watched by Insider Monkey, comprising an estimated $51.8 million in call options. Dmitry Balyasny’s fund, Balyasny Asset Management, also dumped its call options, about $16.8 million worth. These moves are important to note, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Agios Pharmaceuticals Inc (NASDAQ:AGIO) but similarly valued. These stocks are Associated Banc Corp (NYSE:ASB), Enstar Group Ltd. (NASDAQ:ESGR), Echostar Corporation (NASDAQ:SATS), and Urban Outfitters, Inc. (NASDAQ:URBN). This group of stocks’ market valuations resemble AGIO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASB | 17 | 297669 | 4 |

| ESGR | 10 | 673382 | -1 |

| SATS | 28 | 443489 | 2 |

| URBN | 31 | 425814 | 4 |

| Average | 21.5 | 460089 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $460 million. That figure was $372 million in AGIO’s case. Urban Outfitters, Inc. (NASDAQ:URBN) is the most popular stock in this table. On the other hand Enstar Group Ltd. (NASDAQ:ESGR) is the least popular one with only 10 bullish hedge fund positions. Agios Pharmaceuticals Inc (NASDAQ:AGIO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard URBN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.